Last week, I had the opportunity of attending the CIMdata Industry and Market Forum in Ann Arbor, MI. This annual gathering, organized by CIMdata, brings together leading PLM (Product Lifecycle Management) vendors to discuss the state of the industry, the economy, and major threads shaping the future. This year’s theme revolved around the concept of Digital Twin, a topic that warrants separate discussion. I’m waiting for CIMdata to share slide decks, so I will be able to share more data points, Meantime, I had some time to digest the information and gather some of my thoughts. In this article, I aim to share the top five takeaways from the forum:

1. Continued Growth of the PLM Industry

Despite challenges in the global economy, the compound value of the PLM industry continues to grow. With an 8.6% increase, slightly below the planned 10.1%, the industry has reached an impressive $73 billion based on CIMdata assessment. A portion of this market, around $9.8 billion, is attributed to cPDM (collaborative Product Data Management), which encompasses systems managing product data and its lifecycle. Those are Aras, Enovia, Teamcenter, Windchill, and similar systems. The big portion of the market based on CIMdata classification is belonging to other types of applications such as EDA, AEC, simulations and others. The total number includes services revenues as well. All together, it reflects the diverse landscape of PLM.

2. PLM Adoption Predominantly Among Large Companies

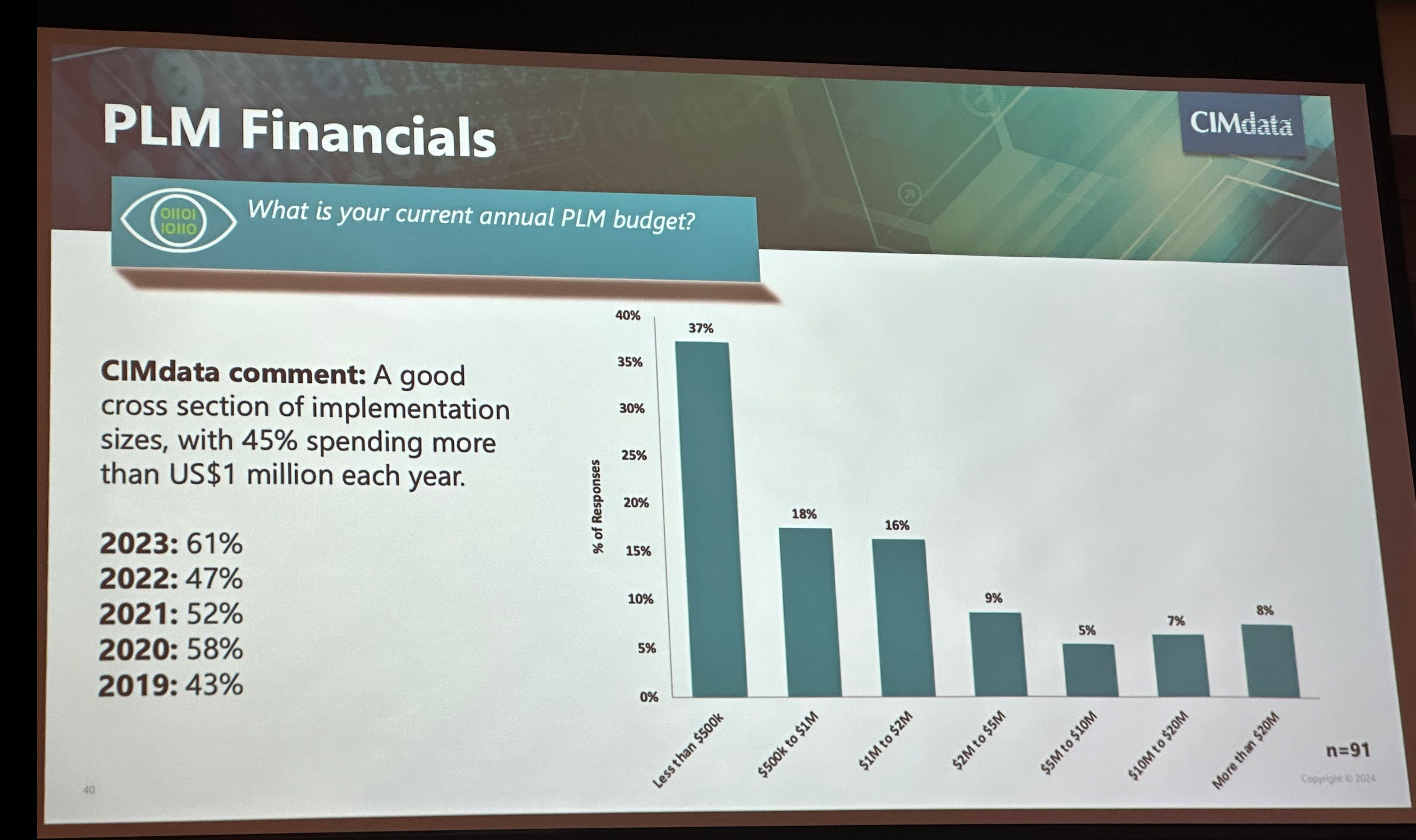

While PLM technologies offer immense benefits, it’s evident that their adoption is still primarily concentrated among large enterprises. According to surveys, only 37% of companies spend less than $500k on PLM. Notably, CIMdata’s breakdown lacks granularity below this threshold, indicating a gap in understanding smaller companies’ PLM investments.

Here is a diversity of companies represented in CIMdata survey. Only 37% of companies spent on PLM less than $500k annually. CIMdata doesn’t provide any breakdown below this number which means that many companies in SMB/SME buying expensive PDM systems and paying $50-80k for licenses and implementation are much below any reasonable CIMdata threshold. It is highlighting the need for broader insights into PLM adoption across all business sizes.

The question about SMB/SMEs is remaining very interesting. Until now, no PLM vendor was able to scale down from selling large enterprise PLM systems to SMB/SME. I don’t think that existing PLM approach can be transformed to solve problems of small companies, but, at the same time, the market there is remaining largely open. But it requires new unit economics, different GTM approach and products. The jury is still out here.

3. The Complexity of PLM Implementations

The complexity is the name of the game in PLM. Implementing PLM isn’t just about adopting new technologies; it involves a comprehensive transformation of people, processes, and technologies. It results in a high level of complexity, positioning PLM strategy and implementation as a complex undertaking . While companies generally seek to enhance efficiency and reduce costs, PLM initiatives often transcend these objectives, becoming integral components of broader business transformations. Consequently, translating high-level business goals into actionable PLM strategies requires careful consideration and customization, reflecting the diverse needs and contexts of different organizations.

4. Focus Areas of PLM Implementations

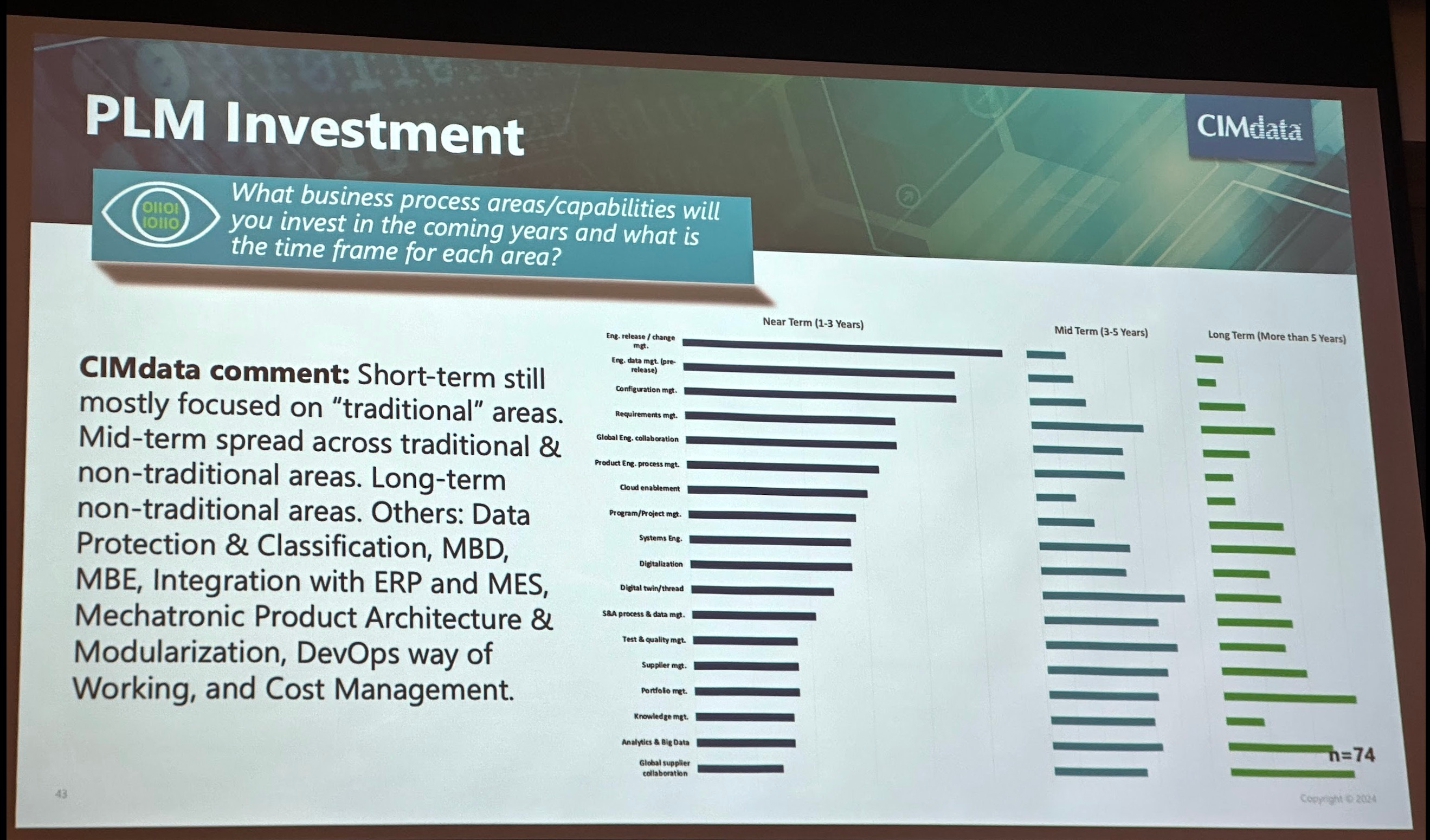

Traditionally, PLM implementations have primarily centered around engineering release, data management, and configuration management. However, emerging priorities, especially within the next 3-5 years, include requirements management, digital twin technology, and quality management.

I can see it as a problem, because it leaves many opportunities of PLM implementation outside of the traditional implementations.

5. Debates Surrounding PLM Definition and Value

Despite its widespread adoption, the definition and value of PLM continue to spark debates and discussions. While there’s unanimous agreement on the importance of managing product data and the necessity of MCAD (Mechanical Computer-Aided Design) and ECAD (Electronic Computer-Aided Design) software, broader questions concerning business transformation and value proposition remain contentious. The diverse interpretations of PLM, coupled with evolving industry landscapes, contribute to ongoing debates, underscoring the need for continuous dialogue and exploration in defining and maximizing the value of PLM initiatives.

What is my conclusion?

Two main challenges of PLM remains complexity and perceived value of complex PLM implementations. Only 15% of answering to CIMdata survey said that PLM is mission critical. I can see here a big misalignment between PLM definitions and strategic value. The CIMdata PLM Industry and Market Forum provided valuable insights into the evolving landscape of PLM. As the industry continues to grow, new challenges and opportunities emerge, with digital transformation and complexity standing out as predominant themes. Digital Twin and Digital Thread are in the focus on many PLM investments by industrial companies. I will talk more about digital twin later this week. By navigating these challenges and leveraging emerging technologies, organizations can harness the full potential of PLM to drive innovation, efficiency, and competitiveness in today’s dynamic market environment.

Best regards, Oleg

Disclaimer: I’m co-founder and CEO of OpenBOM developing a digital-thread platform with cloud-native PDM & PLM capabilities to manage product data lifecycle and connect manufacturers, construction companies, and their supply chain networks. My opinion can be unintentionally biased.