I just came back from Ann Arbor this week for the CIMdata PLM Market & Industry Forum. It is a good place to catch up on Product Lifecycle Management news and talk to industry analysts and CAD/PLM vendors. It is a place to talk about product data management, PLM systems and trending topics in PLM solutions and business processes. Product development process, product data, process management and document management are key topics that triggering questions and demand for solutions – CIMdata covered them all.

You’re getting a digested portion of the annual PLM news about PLM solution providers, business systems, supply chain, quality management, production process, change management, service lifecycle management and many others just in one day and staying up to the speed of PLM community.

Here are my 12 key observations from the 2025 CIMdata Industry and Market Forum:

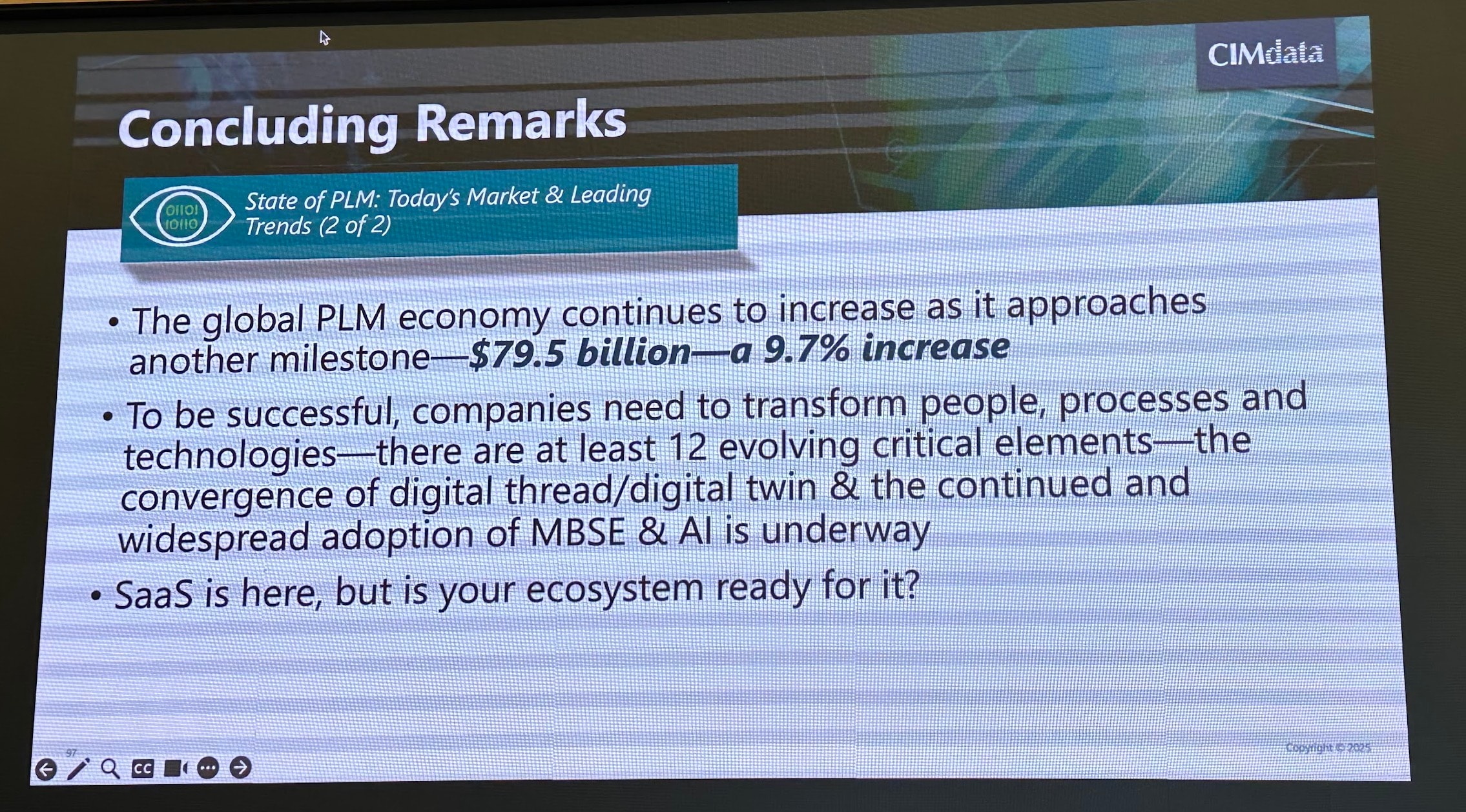

PLM Business is Growing

The PLM market is approaching a new milestone: $79.5 billion. This growth shows how PLM continues to be a core part of the digital transformation in engineering and manufacturing. PLM “economy” outperformed CIMdata’s estimation for the last year – 9.7% increase. But the devil is in details. You need to learn what is “PLM” in CIMdata terms and get into more structured view of segment. The most relevant for “traditional” PLM readers is so called cPDm (Collaborative Product Definition Management). Note: I’ve heard that CIMdata like to change the segmentation and names too that existed for decades.

SaaS Is Mainstream, But Ecosystem Readiness Lags

SaaS has taken over, but the real question CIMdata asked was: Is your ecosystem ready for it? That’s a strong signal to vendors and customers alike that SaaS adoption isn’t just about the tools—it’s about readiness for change.

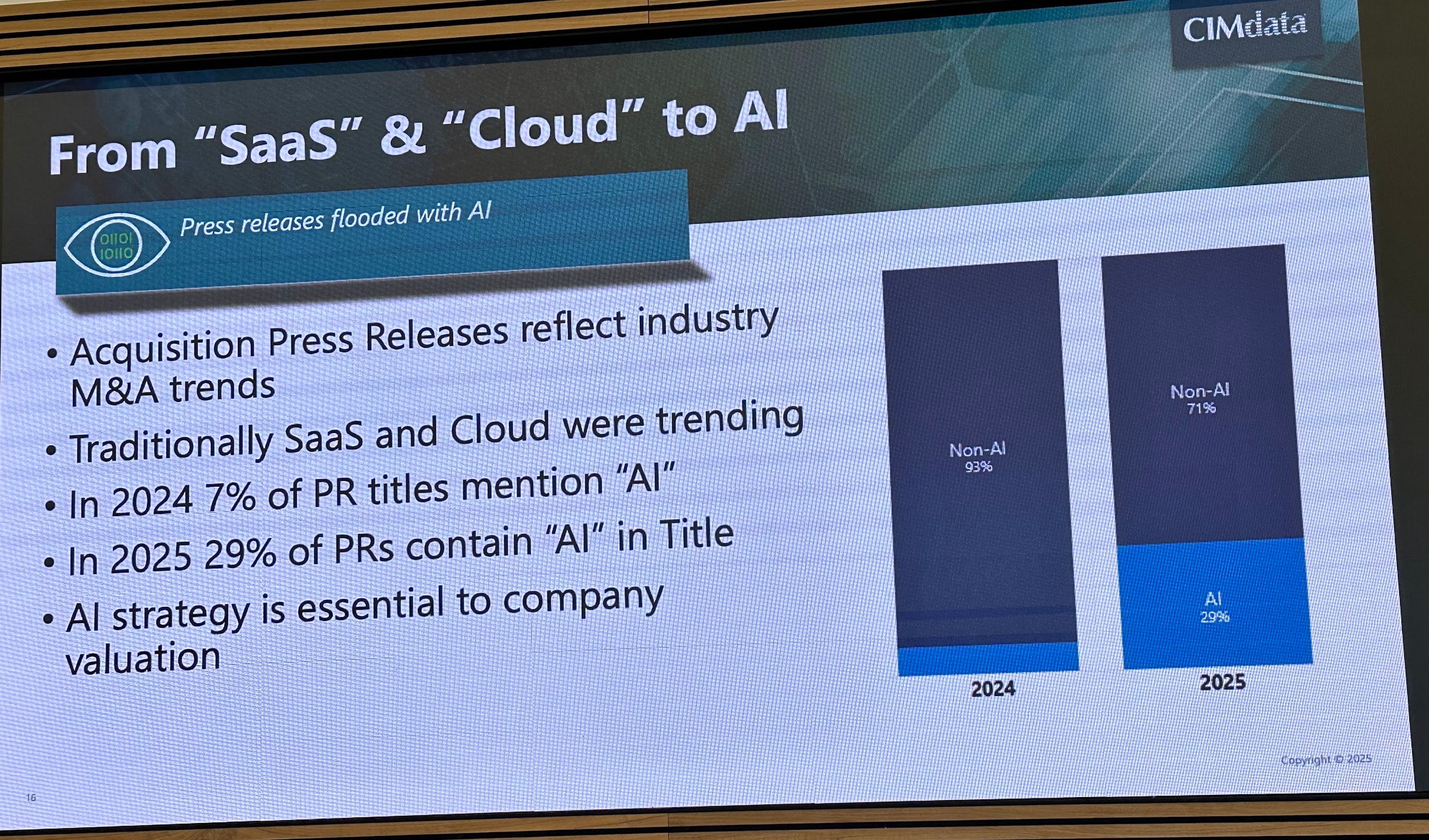

Potential for M&A, but you need to name yourself as “AI”

From M&A perspective SaaS was outperformed by AI. So, if you like your company be acquired, change the name to AI (it is a joke, but as you know, there is always something serious in every joke)

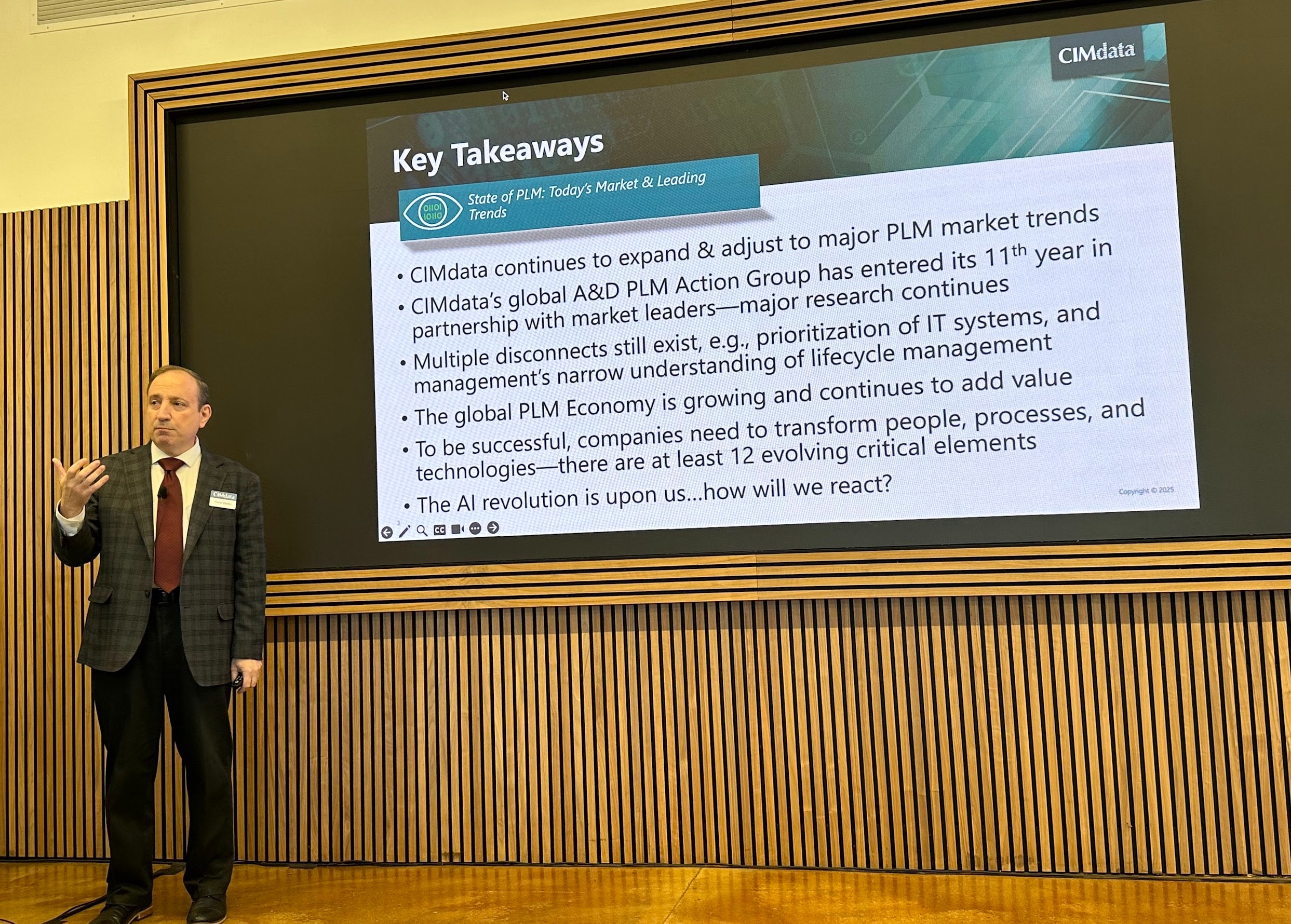

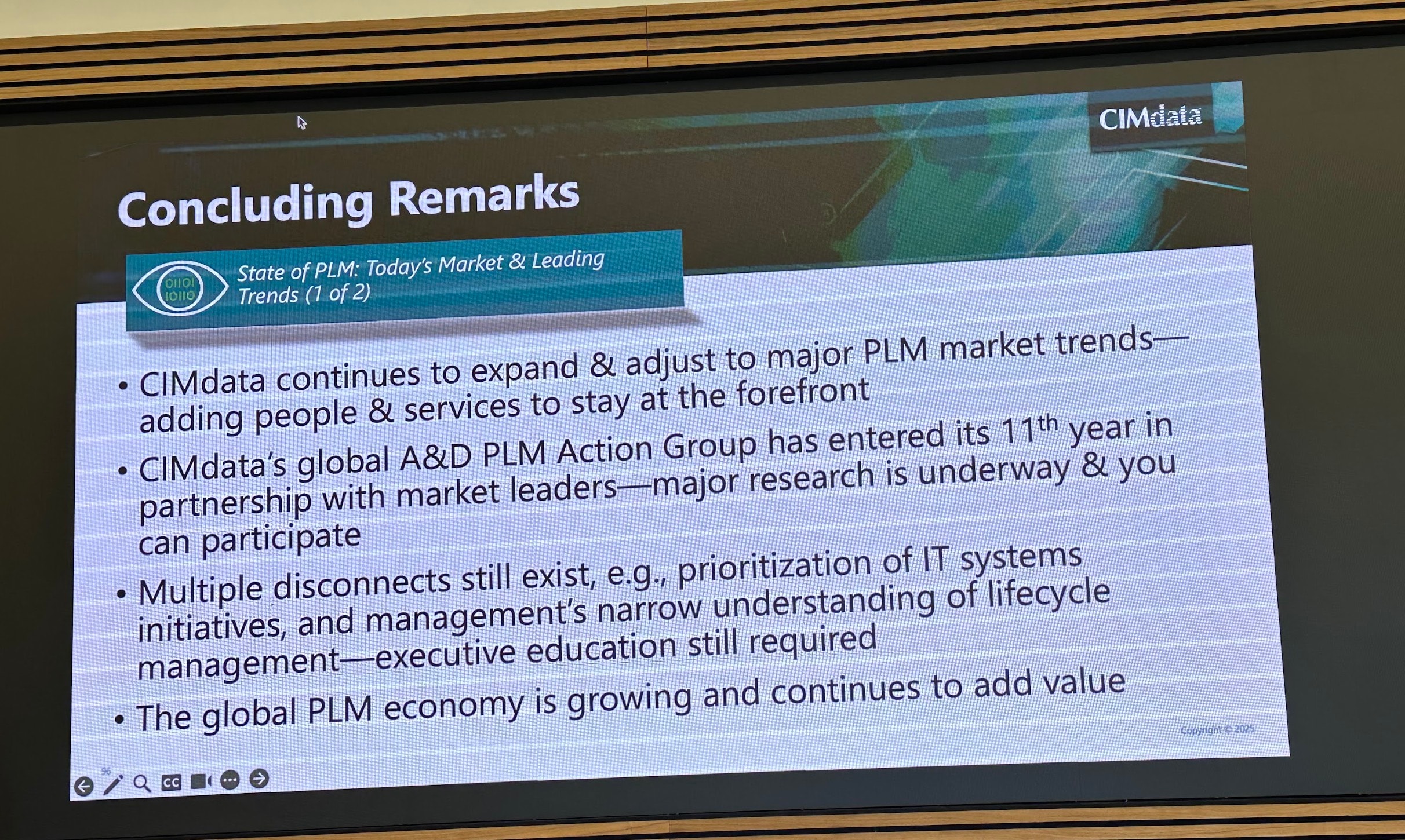

Key Takeaways Reflect Broader PLM Challenges

There are still disconnects in the industry—particularly in how executives perceive lifecycle management. AI is rising fast, but understanding and alignment are essential to unlock value.

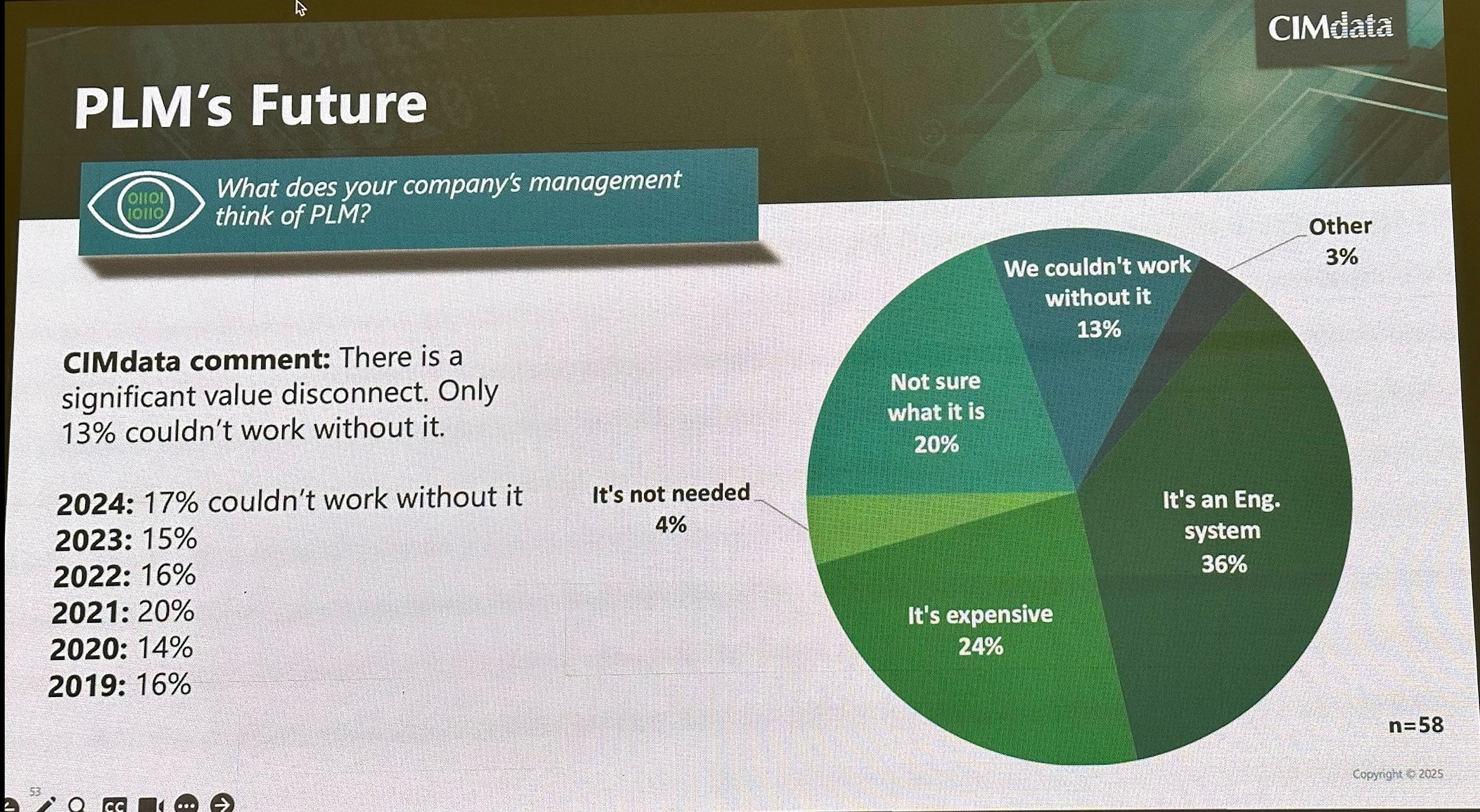

PLM’s Future? A Mixed Picture

PLM for years established itself as a complex engineering tool The downhill trend continues. Only 13% of surveyed companies say they couldn’t work without PLM. That number was 17% last year. A big chunk of management still sees PLM as an “engineering system” or doesn’t understand what it is. I’d say “Houston, we have a problem…”

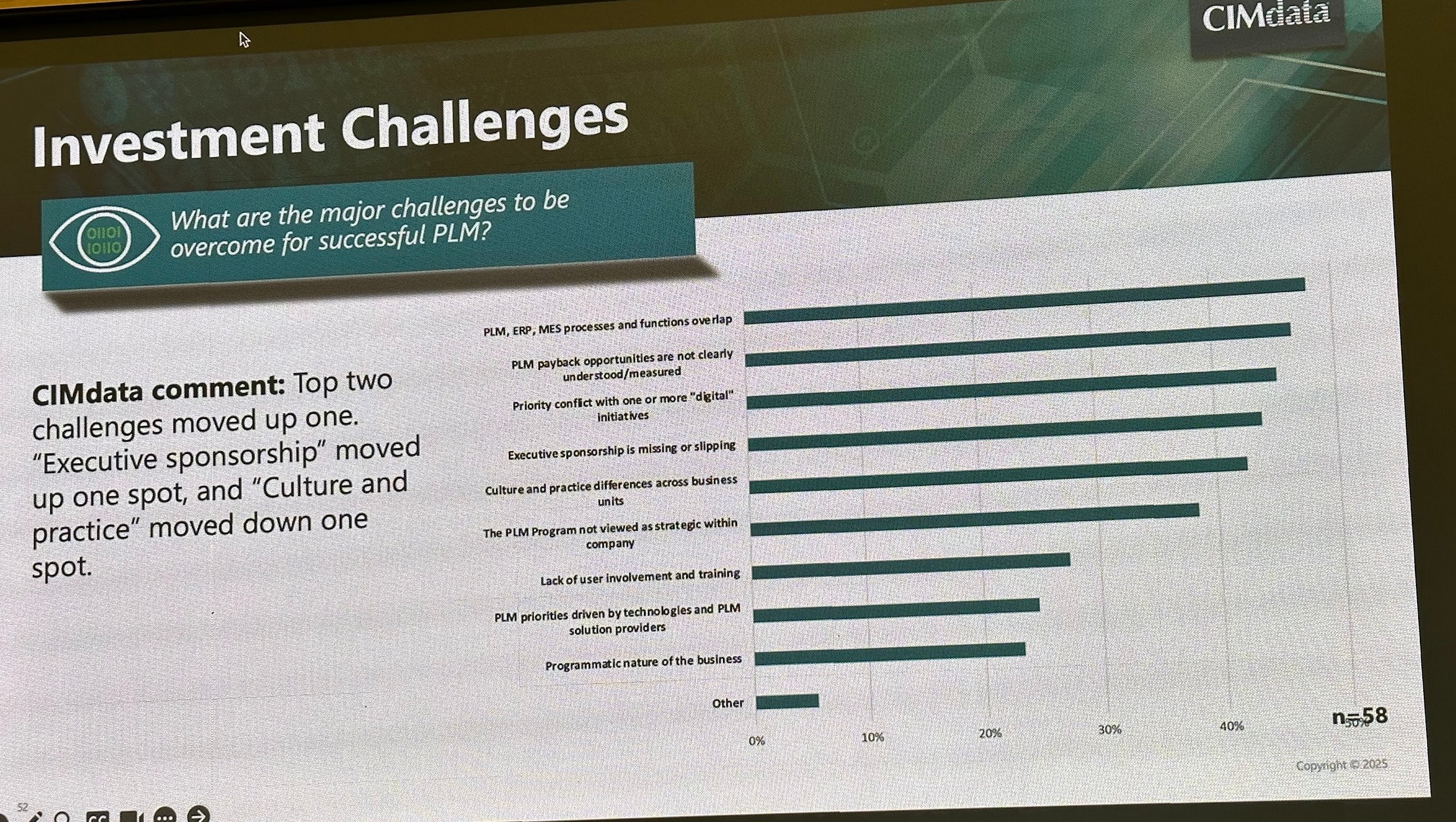

Major Investment Challenges Remain

Top PLM investment barriers: process/function overlaps, unclear ROI, and competing priorities. Executive sponsorship is improving but remains a top issue. Cultural alignment is still tough.

From my perspective, it is very much related to 13% from above. Managers are looking what “TLA” to invest in the future and PLM might not be a winner – new “lovable” terms should be coming such as Digital Thread as a Service and few others.

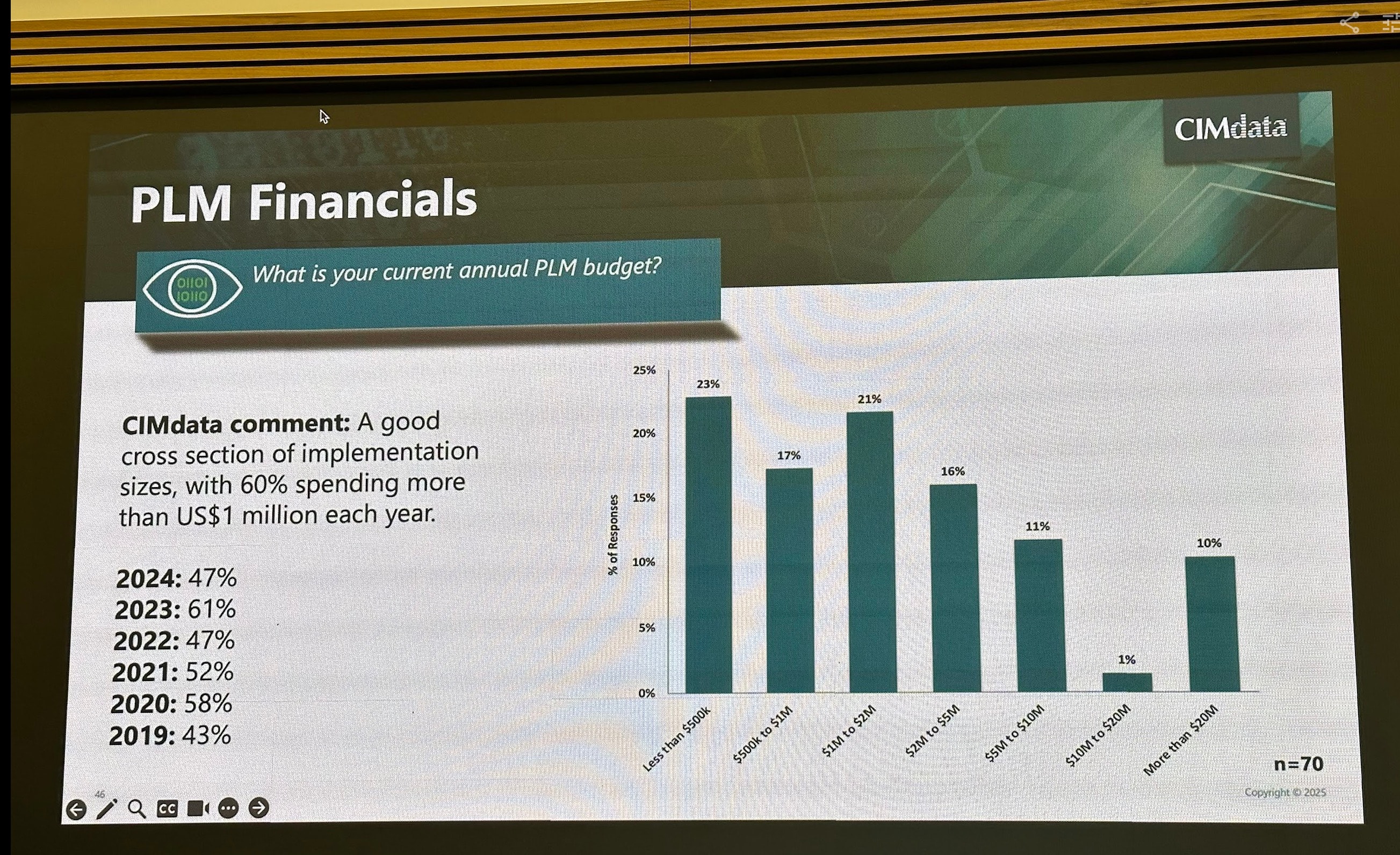

PLM Budgets – Democratization is at Risk

60% of respondents are spending over $1M annually on PLM. While 2023 saw higher numbers, 2024 still shows strong commitment. The market is diverse in budget size, from <$500K to over $20M.

While those are good numbers, I’d suggest the lack of PLM business beyond $500K limits the market to a very large companies. CIMdata doesn’t breakdown the market below 500K, but following 80/20 rule, PLM business remains dedicated to large companies.

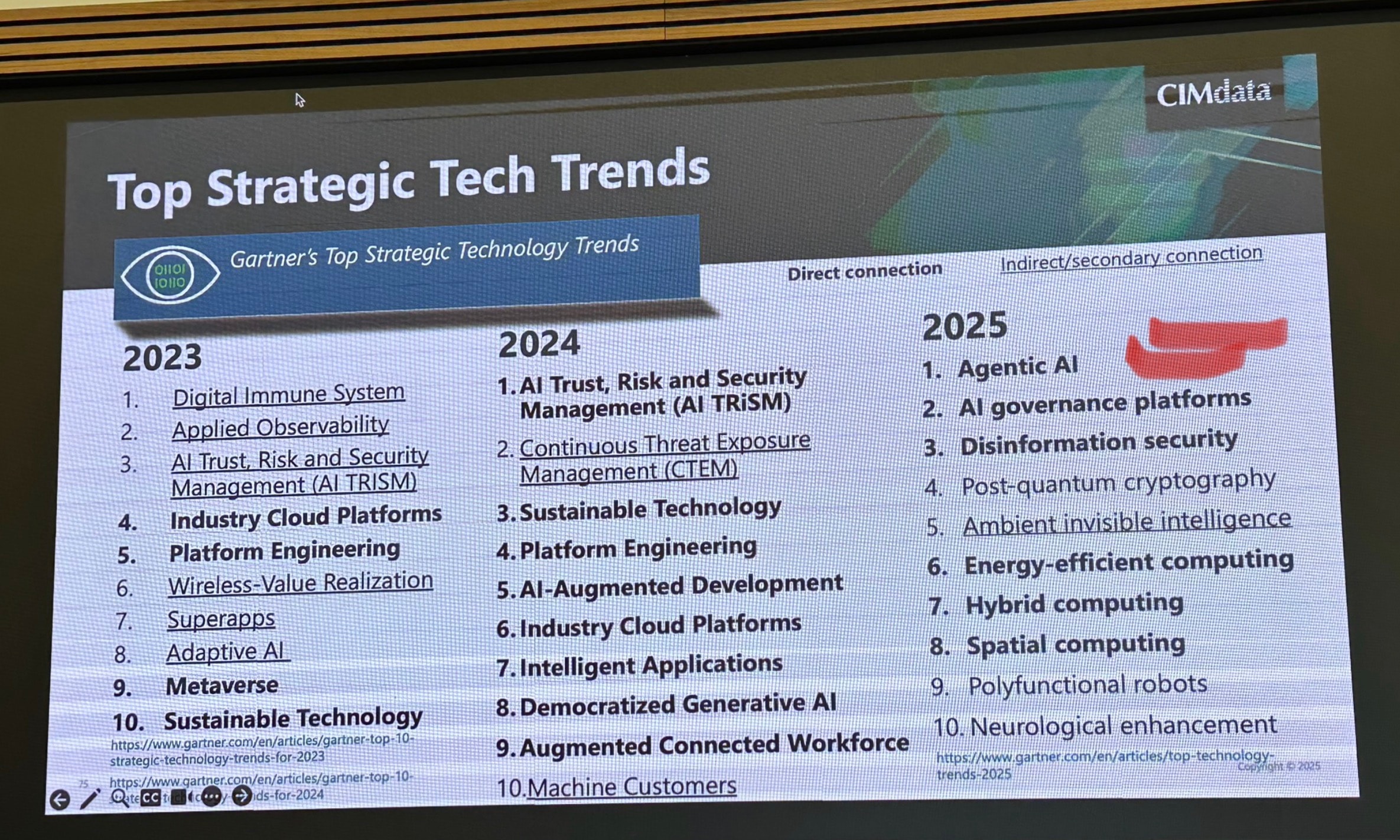

Gartner Tech Trends Are Shaping PLM

The evolution from 2023 to 2025 shows AI trust, platform engineering, and sustainable tech holding strong. In 2025, expect agentic AI, spatial computing, and post-quantum cryptography to emerge in relevance.

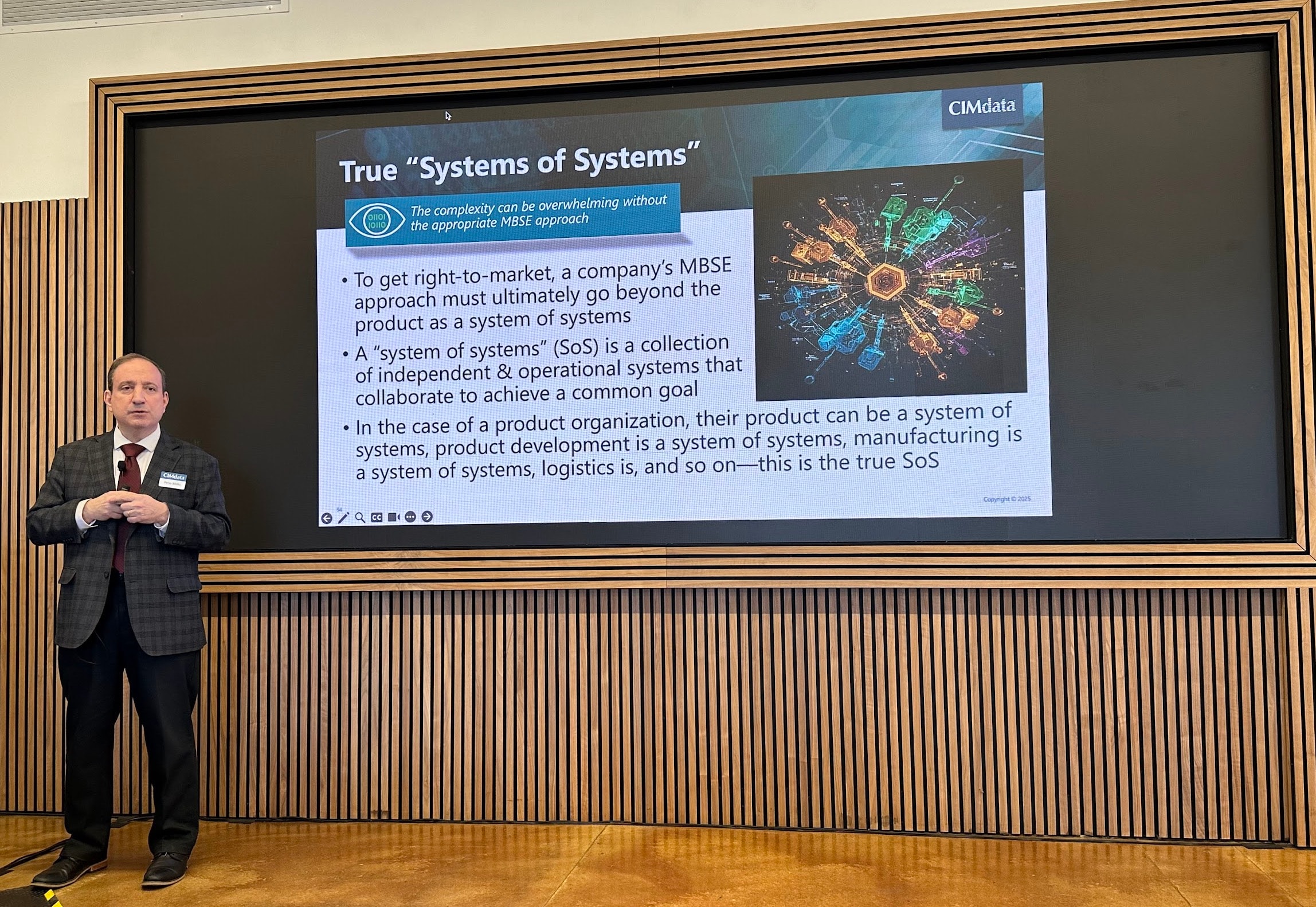

Systems of Systems and MBSE Frontier

CIMdata emphasized MBSE as a strategy for managing complexity—not just models, but connected, dynamic systems of systems. This is critical for organizations working on multi-domain, integrated products.

I will write a separate article about it. The complexity is a big driver for PLM development, but I found MBSE quite challenging and controversial topic.

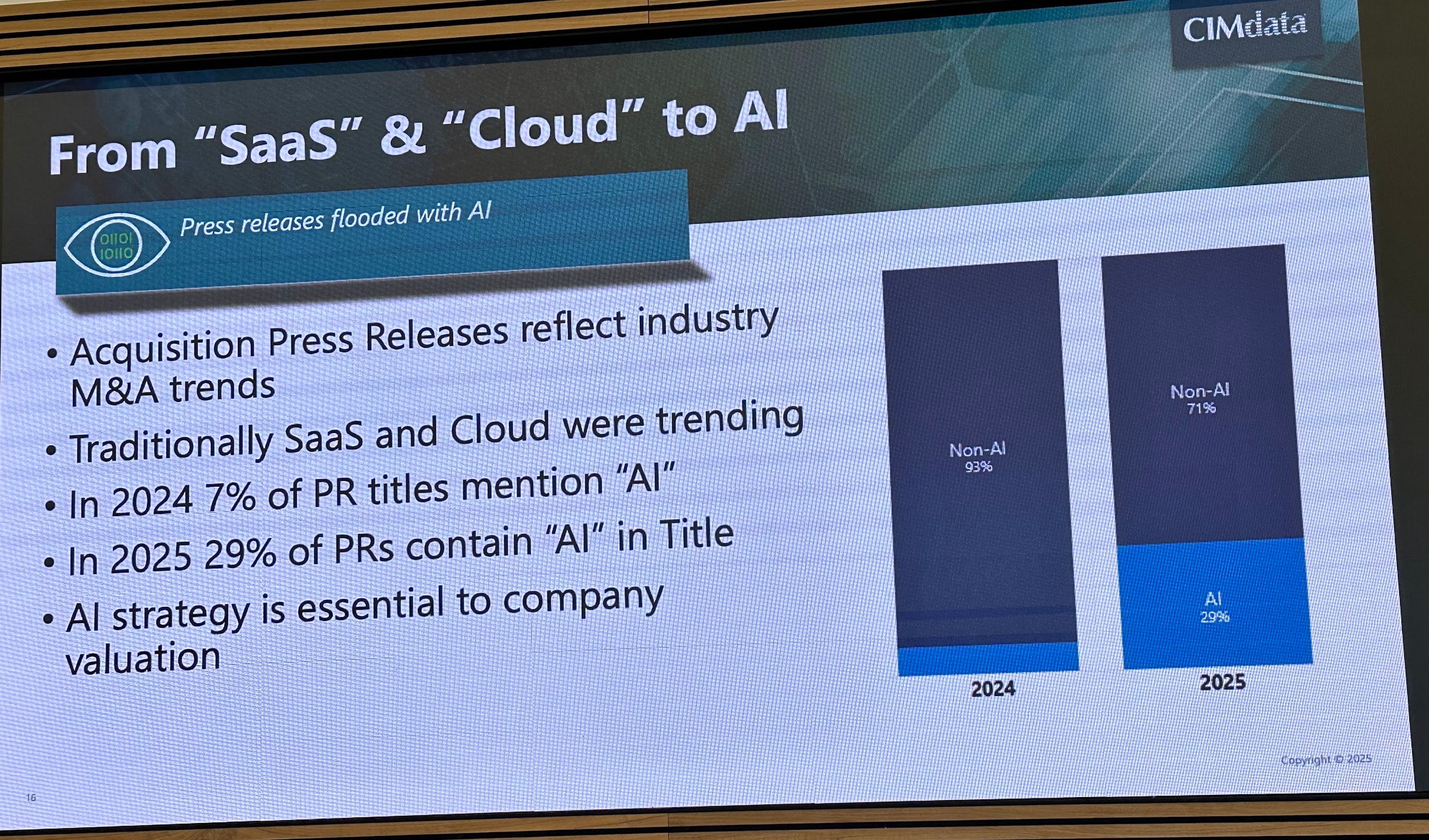

From Cloud to AI in Messaging and Strategy

29% of press releases in 2025 mention ‘AI’—up from just 7% in 2024. This reflects a sharp pivot in the industry narrative. AI is not optional—vendors need to show real strategy.

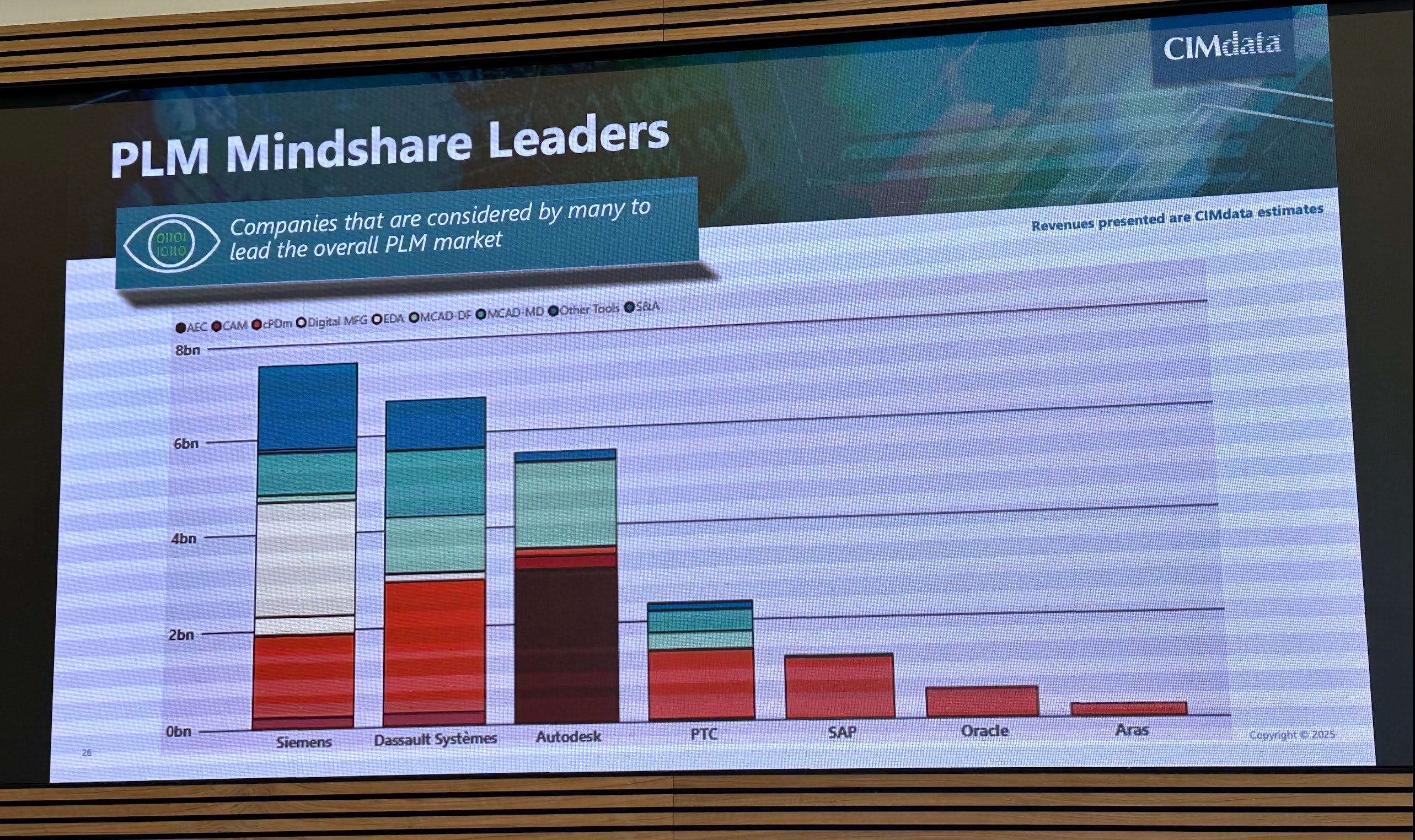

PLM Mindshare Leaders by Revenue

Money talks. So, here are the winner. The list remains the same for decades. Siemens and Dassault remain on top, followed by Autodesk and PTC. Aras was added there recently because CIMdata believes Aras impact on PLM software is significant.

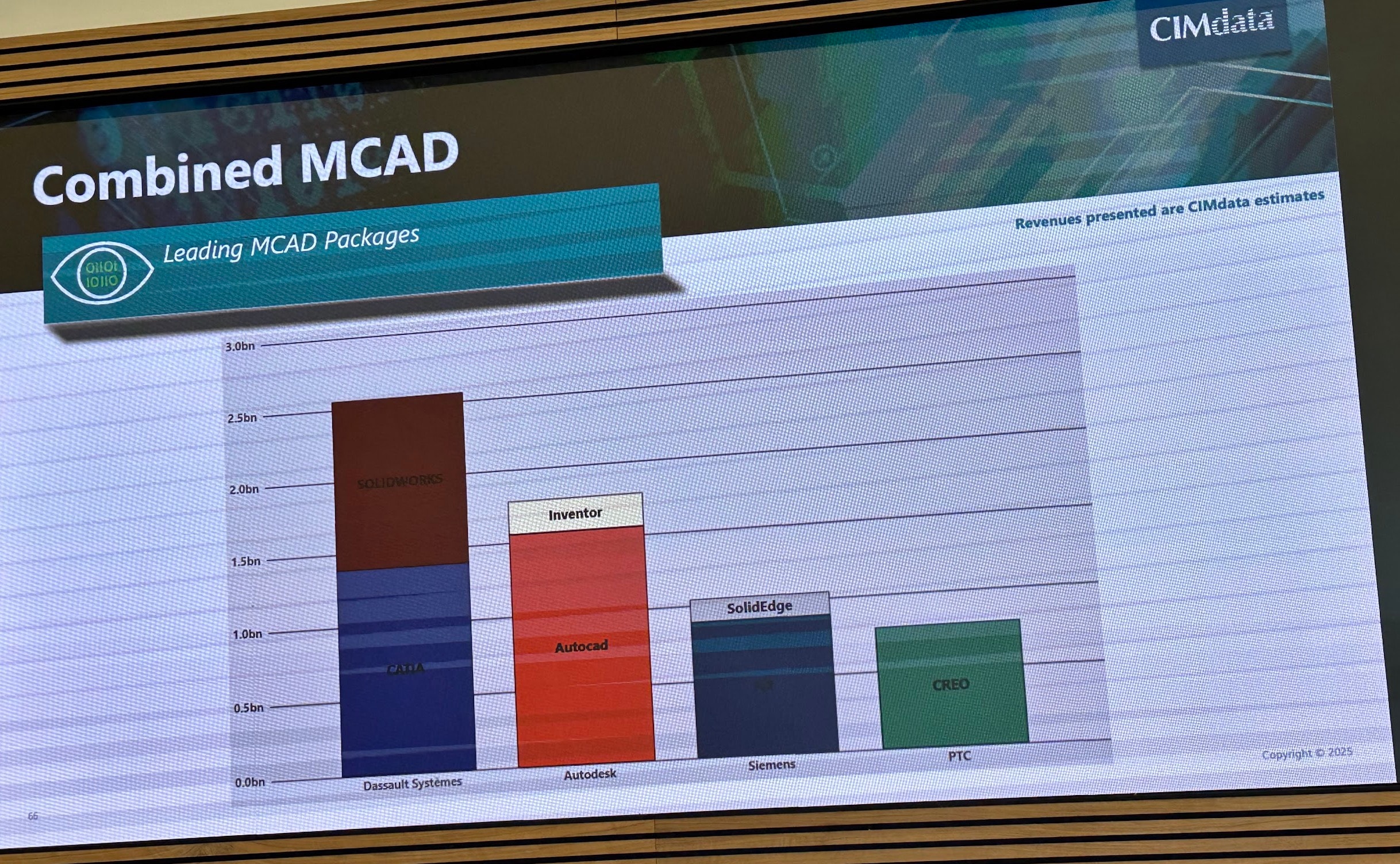

MCAD Market Share Snapshot

The context of MCAD market is important because historically PLM software has roots in MCAD and the attachment to MCAD is significant.

Dassault’s SolidWorks leads the MCAD market, followed by Autodesk’s Inventor and AutoCAD. Siemens SolidEdge and PTC Creo show stable adoption but trail in revenue. This view confirms the continued strength of mid-range MCAD solutions with the dominance of SolidWorks and AutoCAD.

Education and Ecosystem Growth Are Still Critical

CIMdata highlighted the need for more executive education and ongoing efforts to align people, processes, and technologies. The A&D PLM Action Group continues to be a vital platform for thought leadership and research.

PLM is more relevant than ever, but the ecosystem needs education, alignment, and transformation leadership to truly capitalize on what’s ahead.

What is my conclusion?

Overall, CIMdata’s Forum painted a clear picture of PLM importance in the industry, growing momentum in new development and… old challenges still presented in the market. I think, PLM is changing and we will see more dramatic changes in the future. PLM vendors adopted SaaS, by hosting their existing products on platforms like AWS, Microsoft, and Google. But it didn’t change the nature of PLM business and software use. Therefore, the opportunity is still significant in democratization of PLM software and making it more appealing to engineering teams and manufacturing businesses Just my thoughts…

Let me know your thoughts—what resonated most with you?

Best, Oleg

Disclaimer: I’m the co-founder and CEO of OpenBOM, a digital-thread platform providing cloud-native collaborative services including PDM, PLM, and ERP capabilities. With extensive experience in federated CAD-PDM and PLM architecture, I’m advocates for agile, open product models and cloud technologies in manufacturing. My opinion can be unintentionally biased