As we are at the midpoint of 2024, it is a good time to take a look at PLM vendors and market to provide a quick review of what vendors are offering and what is on their mind. Keep in mind that my article research and summary is not scientific, but mostly insight and thoughts based on what I read and hear.

Here are some of the references: my article following CIMdata PLM Market and Industry Forum 2024 in Ann Arbor. Also my top 5 takeaways form CIMdata forum. Check presentations by Peter Bilello and Stan Przybylinski I also recommend you to attend the webinar hosted by Aras’ and moderated by Aras’ CMO Josh Epstein – Pulling Digital Thread. A few other places to check is my webinar with Adam Keating of CoLab and MJ Smith about PLM and System of Engagement. I also recommend you to checkTEC reports about Dassault Analyst event in Paris. Also, check Siemens Realize Live event 2024 in Las Vegas as well as my notes from Autodesk University PLM Summit 2023 in Las Vegas. Recent SAP PLM update made by Ismail Serin about SAP PLM Strategy can be found here. Last, but not least PTC LiveWorx event, which is not happening this year, but you can find my notes from 2023 here.

One size doesn’t fit all in PLM business and PLM software. It is extremely important to get a balance perspective of tools, vendors’ strategies and directions for both short and long term. Product Lifecycle Management (PLM) market remains a dynamic and competitive landscape. Leading vendors continue to innovate (and acquire) to expand their offerings to meet the evolving needs of the industry. Newcomers are becoming stronger and developing various niches of the market. And customers are continue to struggle. Check my article about 5 Critical Problems in Engineering and Manufacturing, exploring a shocking data point about PLM adoption shared by CIMdata.

If you’re researching PLM software, I’d recommend you a few sources. Here they are CIMdata Industry and Market report – this is an analyst perspective, G2 PLM reviews (G2 collects customer reviews, so it will be users’ perspective).

For a comprehensive view of the competitive landscape in engineering software, refer to Blake Courter’s Engineering Software Moat Map, which I found as an interesting source of information about startups.

This article provides a mid-year check on some of the most prominent PLM vendors as well as startup and growing businesses. You can also find useful links you can navigate later to dig deeper.

Siemens Industrial Software

Siemens continues to be a leading force in the PLM market with its comprehensive suite of solutions under the Siemens Digital Industries Software umbrella. The company’s flagship product, Teamcenter, remains a cornerstone for many manufacturers. Siemens is pushing the envelope with advancements in digital twin technology, integrating IoT capabilities through MindSphere, and leveraging its Xcelerator platform to provide a holistic approach to digital transformation.

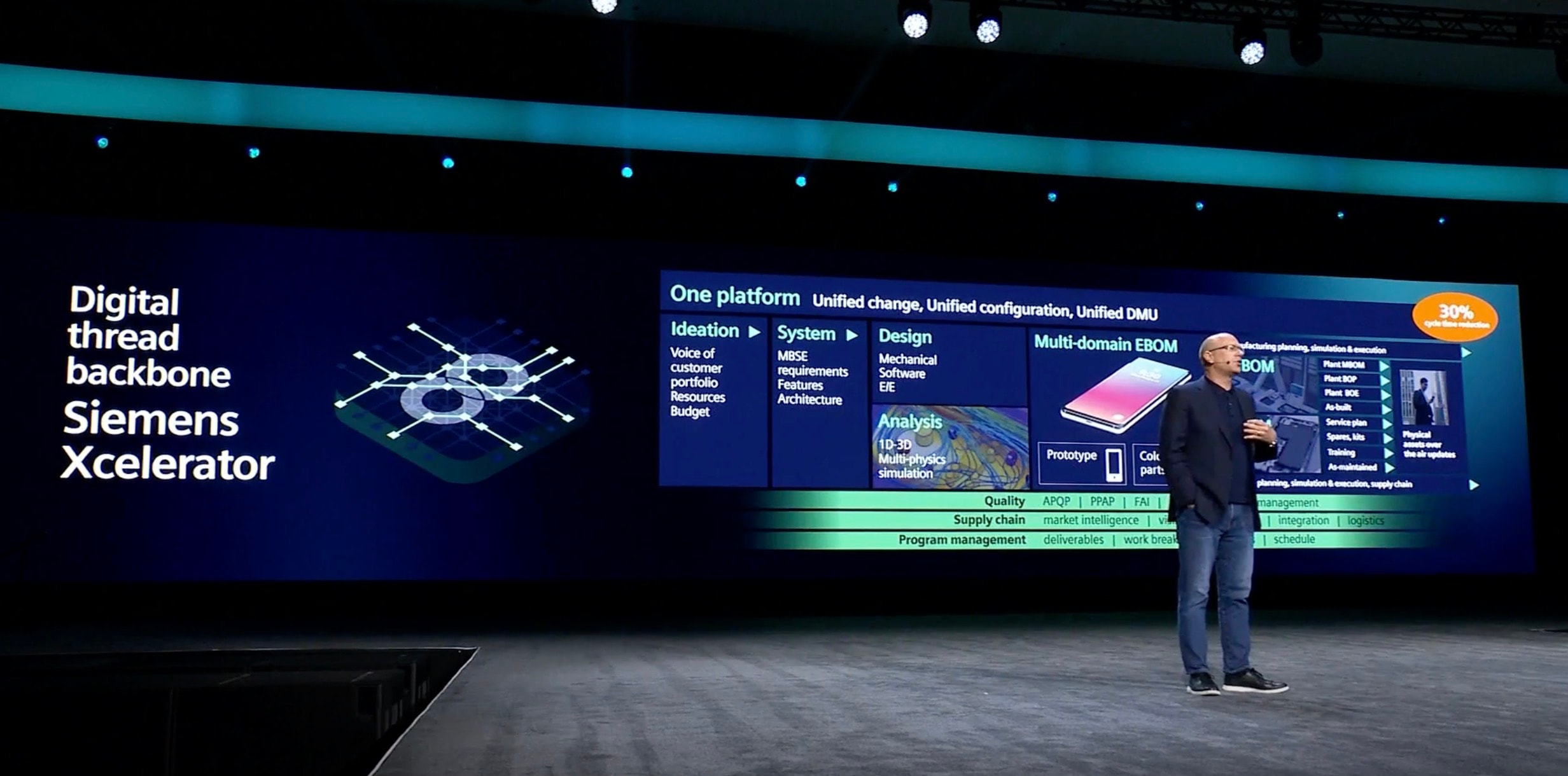

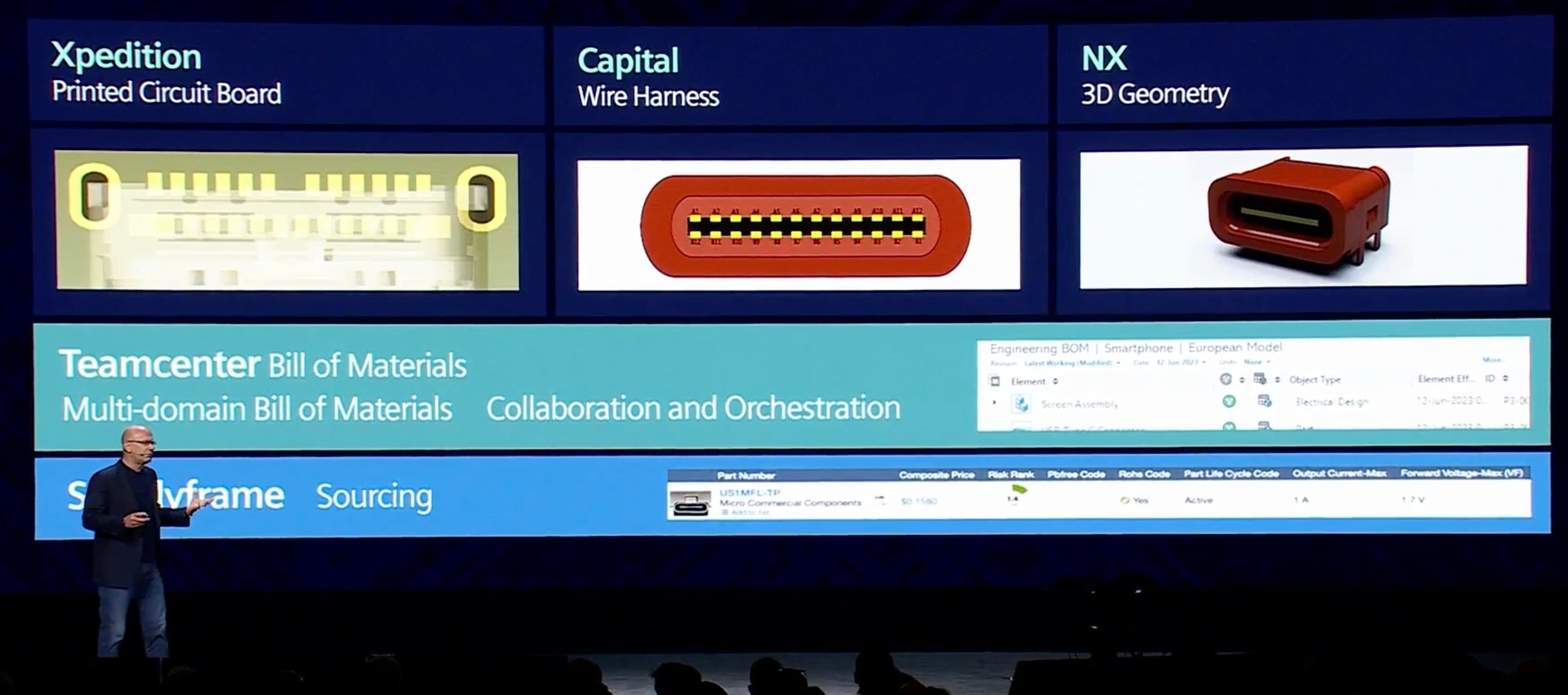

The 2024 strategy for Siemens is coming to the four topics – digital threads, cloud, AI, and industrial metaverse. Here are a few screenshots I captured form Realize Live event. According to them the data is becoming really critical and must be used to connect multiple domains of data into digital thread.

The picture below explains the Siemens strategy.

The engine behind this is Teamcenter, which holds the entire information set.

When it comes to serving diverse set of customers (from small to enterprise), traditional challenge is to serve companies of different sizes, cloud is a leading strategy. NXX and TeamcenterX Essential are examples of recent innovation allowing to push existing products to the cloud. How effective it will be for Siemens- time will show.

Dassault Systèmes

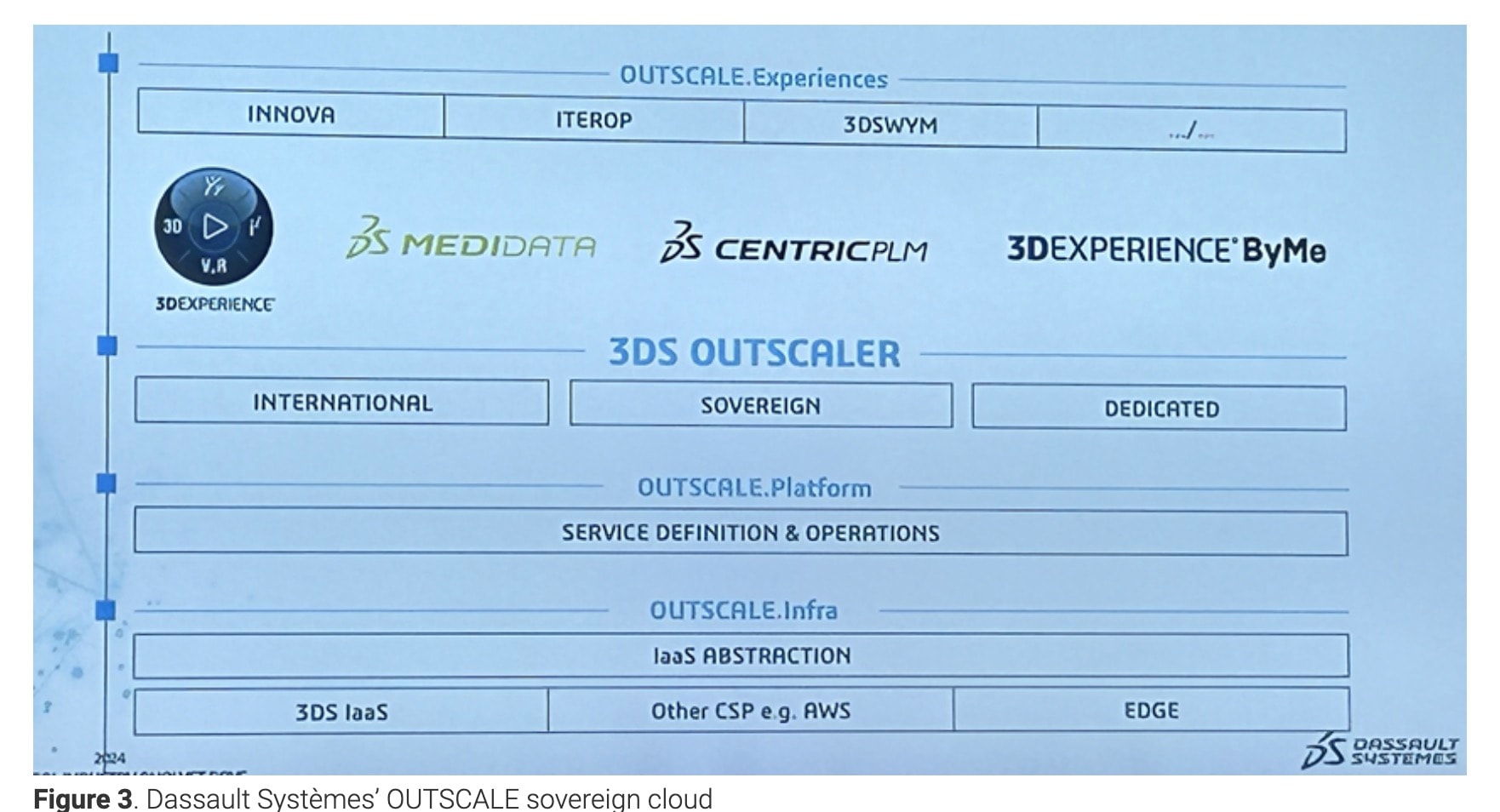

Dassault Systèmes, renowned for its 3DEXPERIENCE platform, maintains a stronghold in the PLM space. The platform’s versatility in addressing various industries from aerospace to life sciences has cemented its position as a leader. Dassault’s focus on providing an immersive, collaborative environment through virtual twins and augmented reality applications is propelling innovation and efficiency across the product lifecycle.

A recent publication by TEC from Dassault Systemes analyst event speaks about DS investment in Outscale- a cloud foundation behind 3DEXPERIENCE platform.

While DS is moving 3DEXPERIENCE to be a universal platform for everything, it important to watch what is happening with their main brands such as SOLIDWORKS. Check my recent articles from 3DEXPERIENCE WORLD 2024, which was a cornerstone of SOLIDWORKS customers.

PTC

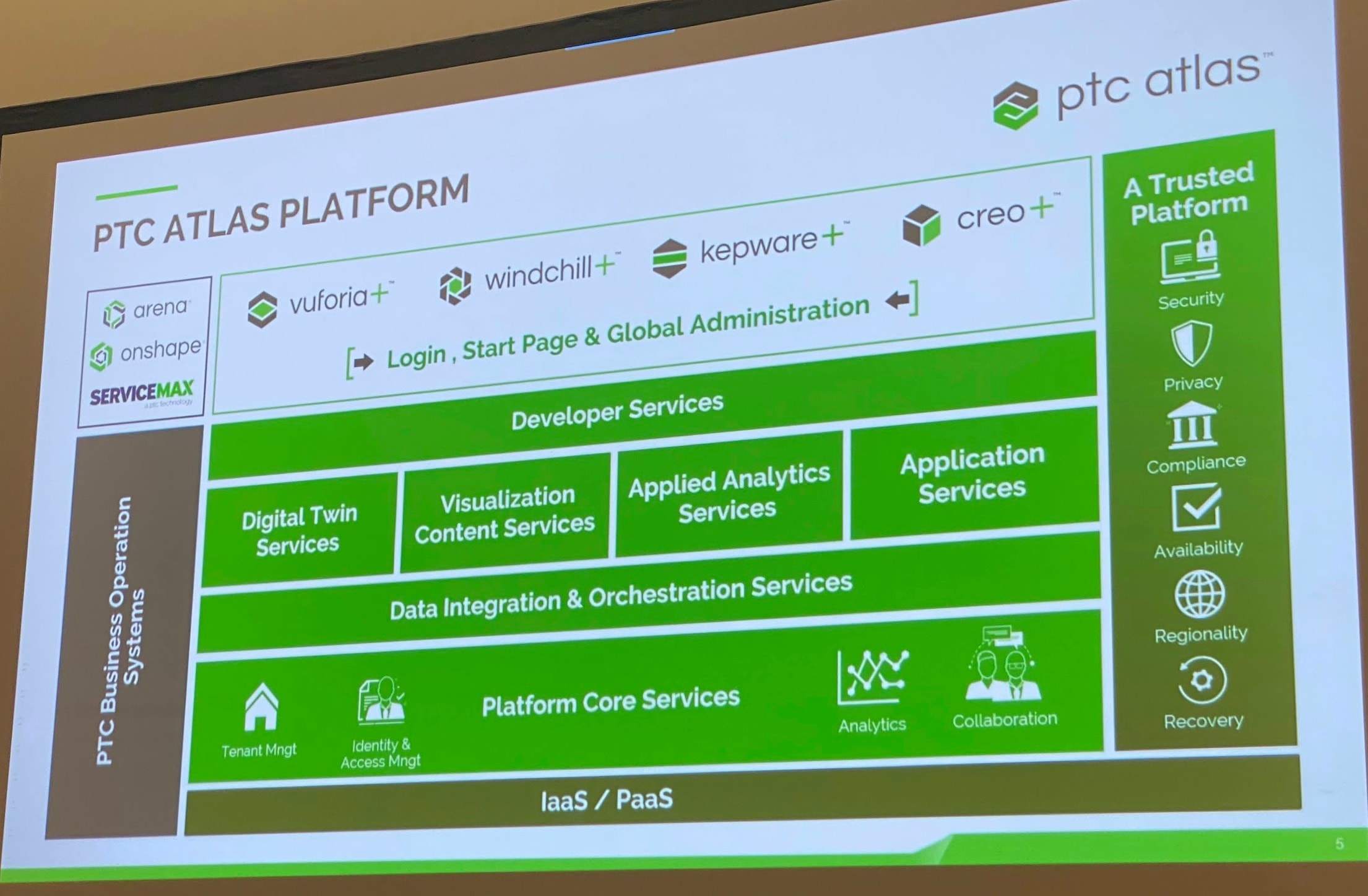

PTC’s Creo and Windchill continue to be a leading PLM solutions, known for its robust capabilities in design product data management and lifecycle visualization. PTC’s strategic partnerships and acquisitions, such as its acquisition of Onshape for cloud-native CAD and IoT solutions through the ThingWorx platform, are strengthening its market presence. The company’s emphasis on SaaS and cloud-based solutions aligns with the industry’s shift towards digital transformation.

A single slide about PTC strategy from LiveWorx23 event states it all. More than $3B dollars was invested by PTC in the last 5 years by acquiring companies with cloud and SaaS focus – Onshape, Arena, ServiceMax. This is just a short list of big acquisitions.

The vision of PTC is Atlas platform build around Onshape acquisition is now five years old and will need to provide a foundation for all products that will be transformed to SaaS. Check the Atlas here.

Aras

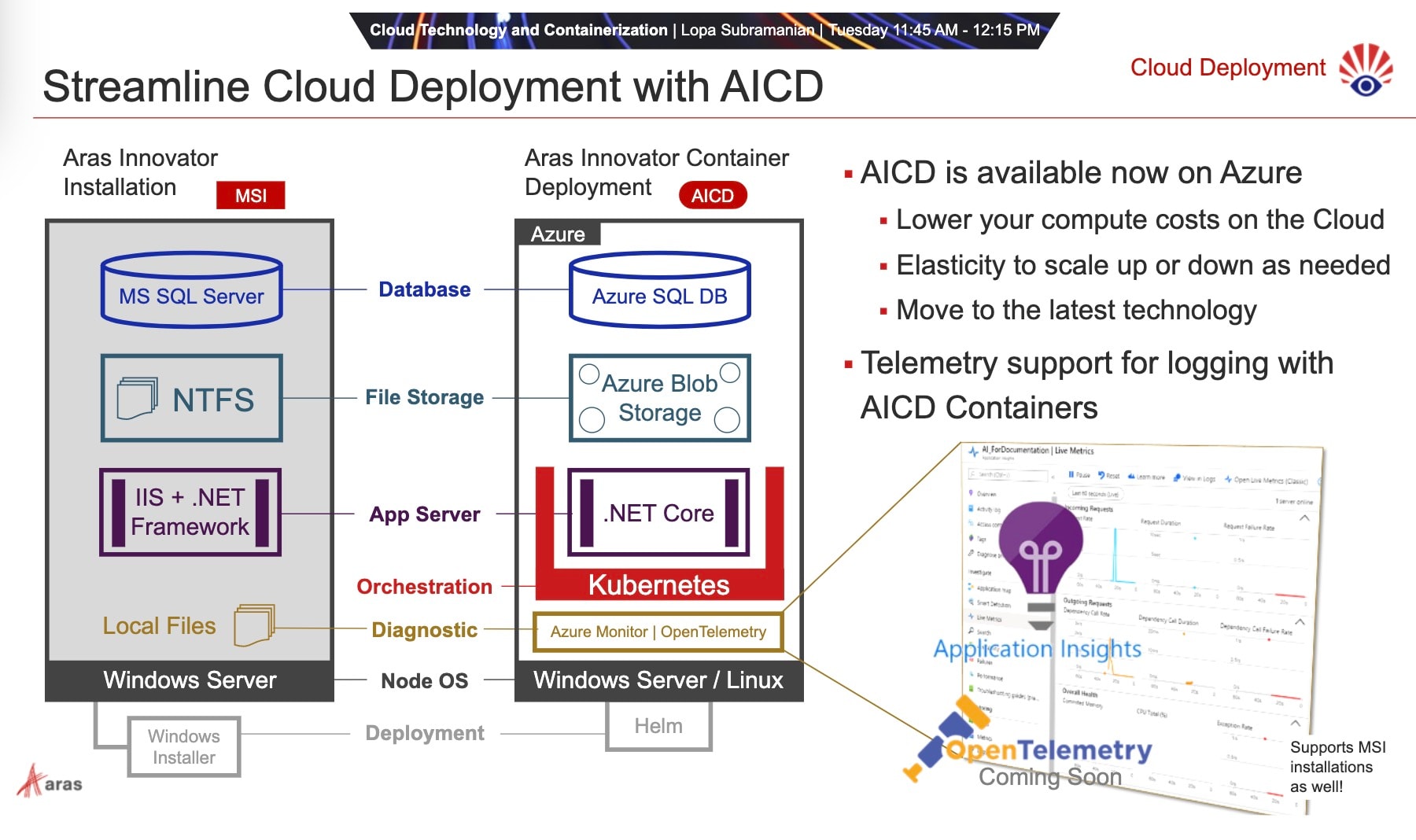

Aras Innovator stands out for its open architecture and flexible, scalable PLM platform. Aras continues to develop its capabilities, particularly in industries requiring high levels of customization and flexibility. Its focus on providing a low-code platform allows businesses to adapt their PLM systems to specific needs without extensive coding, making it a compelling choice for enterprises looking for agility and rapid deployment.

The breakthrough innovation of Aras is delivery of enterprise open source of their platform (Innovator), which can be freely download and later sold as service to the customers. Seamless upgrades made Aras famous at the time, when all other vendors required a lot of money and effort to upgrade their platforms. It has been some time, since I attended ACE event.

A more recent picture of Aras vision can be found here.

A few years ago, Aras was acquired by GI Partners.

Autodesk

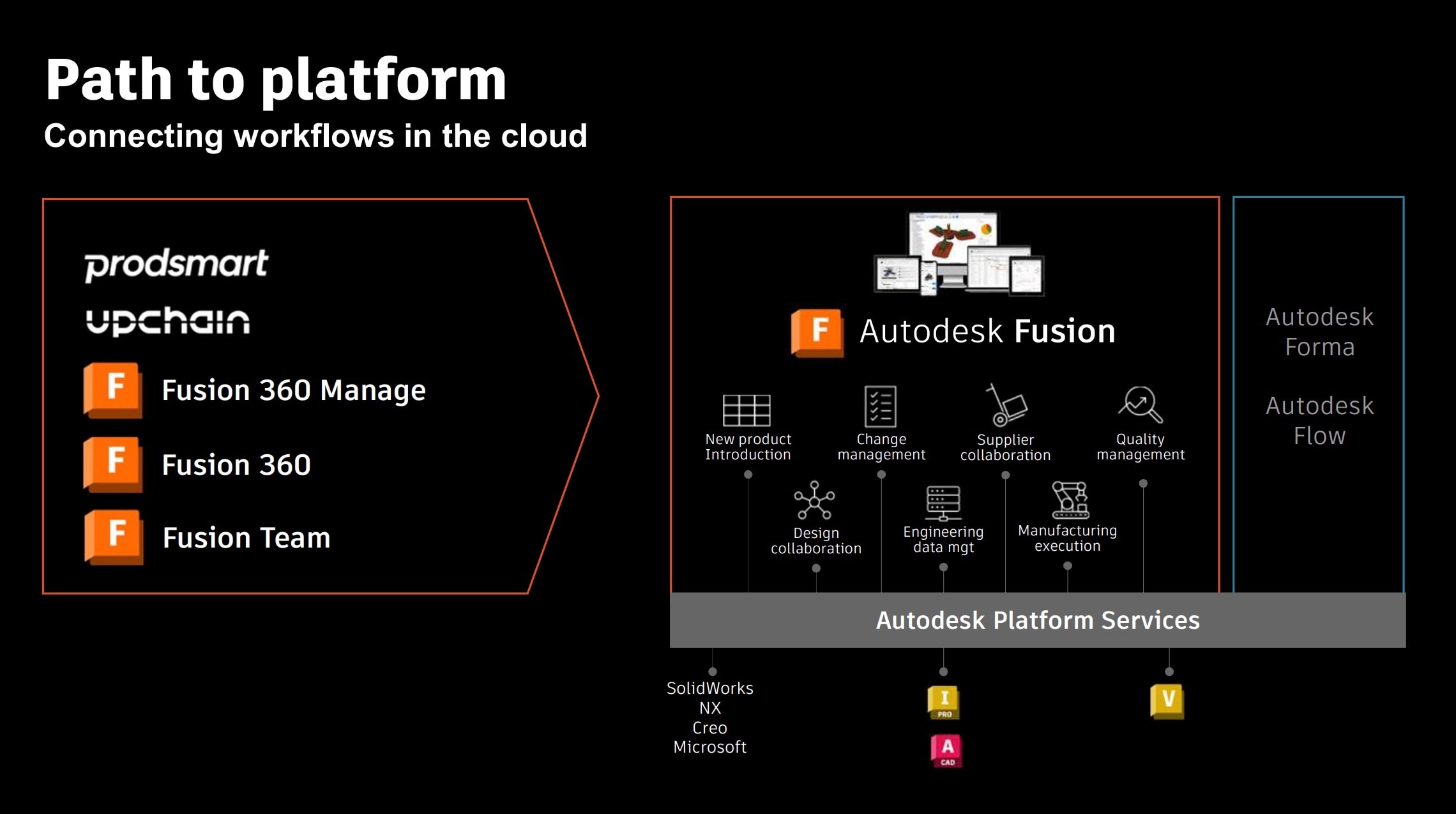

Autodesk’s PLM strategy started from long time acquired Autodesk Vault and multiple acquisitions of PLM products for the last 10 years. You can read more about it on my blog. I learned about recent development of PLM at Autodesk University PLM summit. Check this out here. What is the most interesting fact about Autodesk is that despite owning multiple solutions, it is currently building another PLM product on top of Autodesk Platform Services.

Autodesk Fusion and Autodesk Vault offer robust PLM and PDM capabilities, particularly appealing to small and mid-sized businesses. Autodesk’s cloud-centric approach and integration with its widely used CAD software create a seamless environment for product development. The jury is out about new products that Autodesk is building and when/how existing products will be retiring of integrated.

SAP PLM

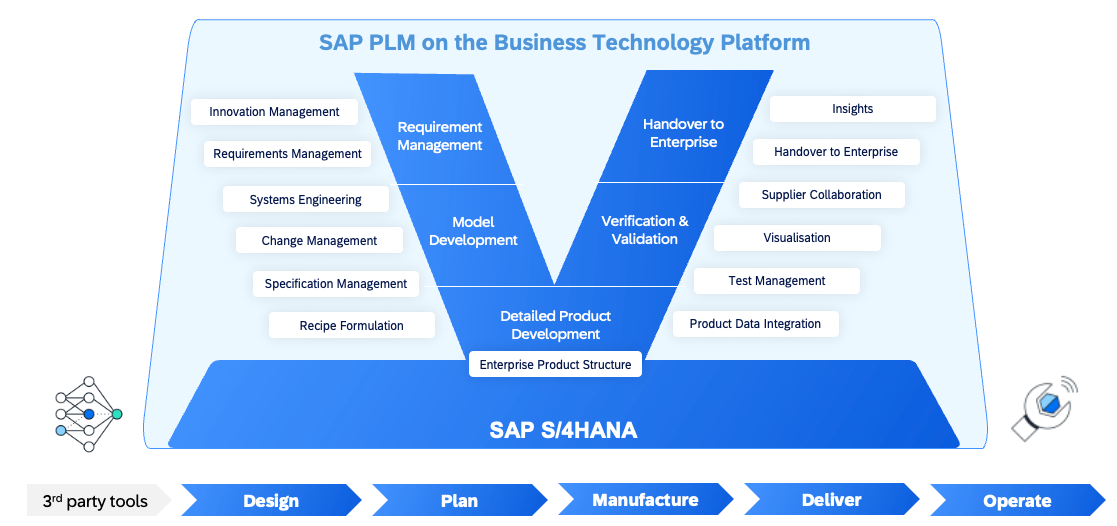

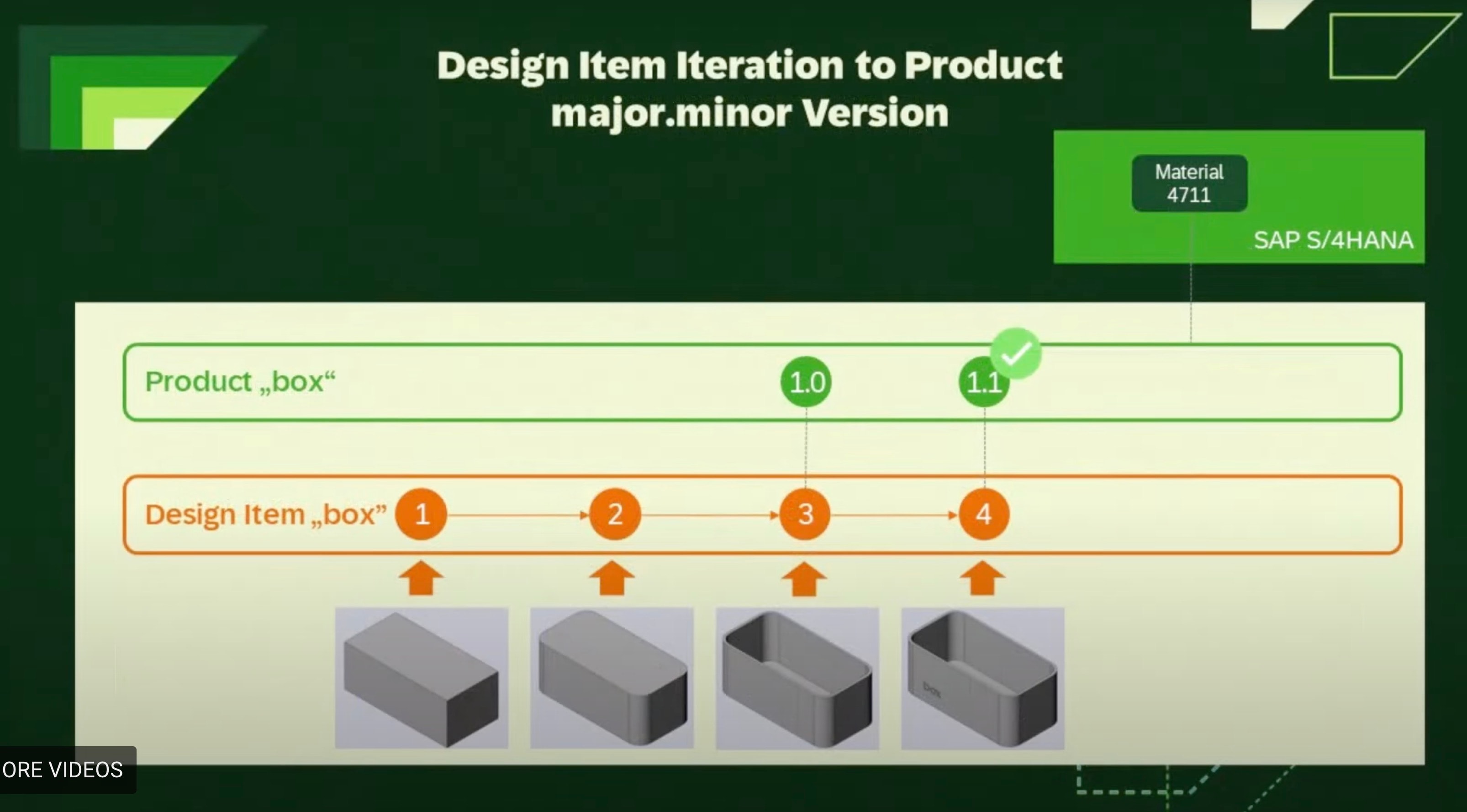

SAP is far from been a newcomer in manufacturing business is coming now with new SAP’s PLM strategy. Suggesting that the new product (and strategy) will reposition SAP PLM as cloud, leveraging SAP S/4HANA platform and highly integrated.

I recommend you to check this presenatation about new cloud PLM development. The new development SAP is coming with is a confirmation of their vision to connect engineering and manufacturing in the modern and reliable form. But it is still hard to stay what is there. The picture that was presented is a very high level and basic scenario. We need to watch more what will be happening there.

At the same time, presenting SAP PLM for S/4HANA, is probably the indicator that the strategy of a complete integration and merging SAP and Teamcenter is over. But, this is my guess. Here is a SAP-Teamcenter integration article on Engineering.com.

Oracle PLM

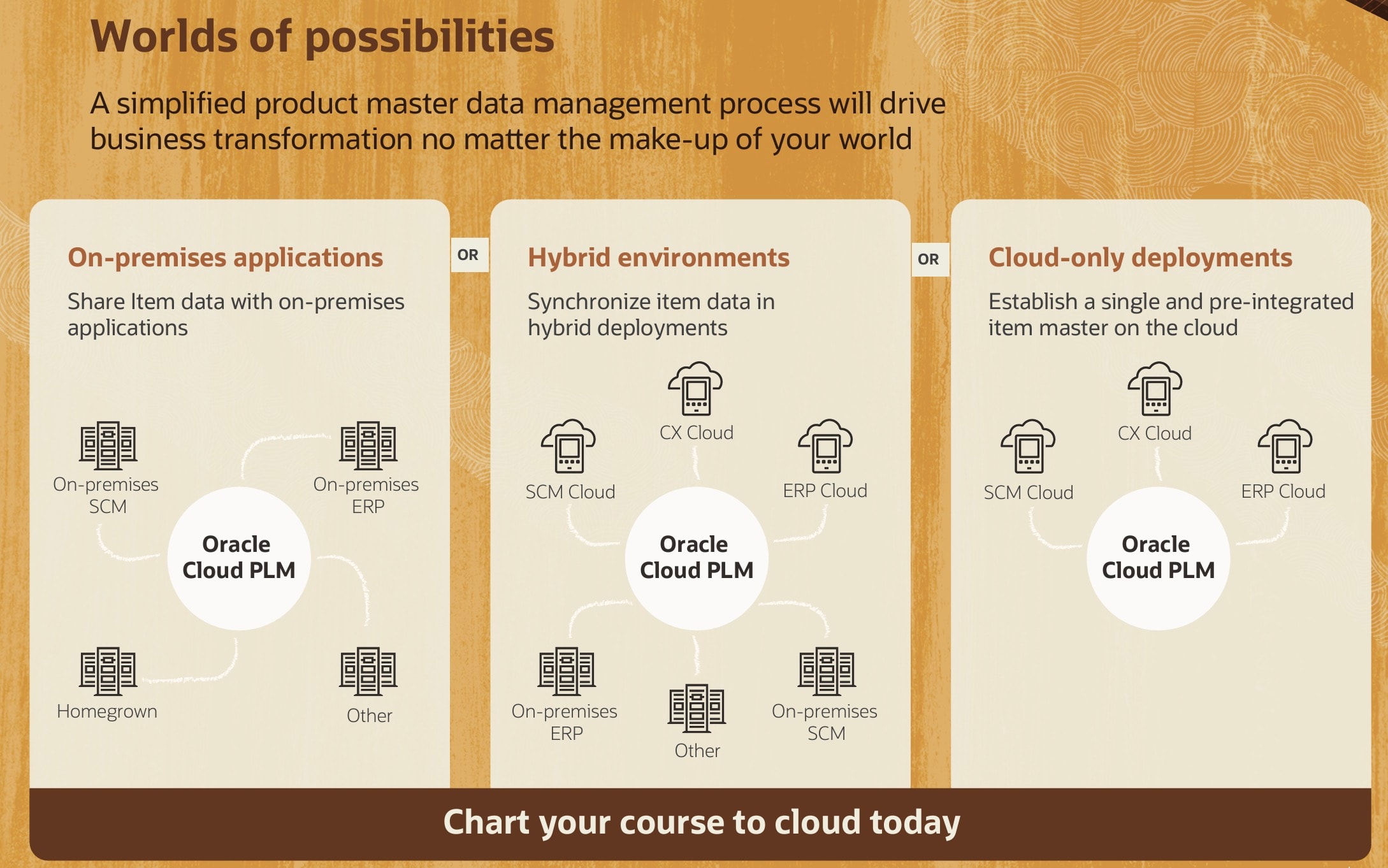

Oracle Fusion cloud is a strategy for Oracle to deliver a modern PLM. Cloud offers a comprehensive suite of applications designed to streamline product development and lifecycle processes. Oracle’s integration of PLM with its broader enterprise applications suite, including ERP and SCM, provides a unified platform for managing business processes. The company’s emphasis on cloud and AI-driven analytics is enhancing decision-making and operational efficiency. Check more information about what Oracle PLM software is offering.

Oracle PLM strategy is transforming from the old and reliable Oracle Agile PLM coming back from Agile PLM acquisition in early 2000s, to a modern Oracle Fusion cloud architecture. Oracle is finally pulling the trigger of stop maintenance of the Agile PLM product.

Emerging Startups Offering PLM Software

It is impossible to mention all startup and emerging companies. I recommend to everyone Blake Courter’s Engineering Software Moat Map. I found as an interesting source of information about companies in engineering and manufacturing industry. Here are three company (in alphabetic order) you should be paying attention to.

Duro PLM

Duro PLM is gaining attention for its streamlined, user-friendly PLM solutions tailored for hardware startups and small to mid-sized manufacturers. The vision of out of the box solution is always attracting customers, but at the same time, raises questions about adaptability. The platform reported to be ease to use, recently extended also to develop multiple integrations. Together, it makes Duro a strong contender in the market. Duro’s focus on rapid deployment and cost-effectiveness is appealing to companies looking to quickly implement PLM solutions out of the box.

OpenBOM

OpenBOM, (transparency- I’m co-founder and CEO), is appealing by its openness and multi-tenant cloud-native approach to PDM and PLM. A combination of unique collaboration, simple Google Sheet-like user experience and comprehensive integration with a large number of CAD and other engineering systems makes it very attractive. The platform’s emphasis on flexible open data models and federated graph based architecture resonates with modern engineering and manufacturing needs. OpenBOM solutions offering cover PDM, PLM and ERP functions for SMB/SME and digital threads for enterprise. A unique approach for New Product Development (NPD) with the capability to unify PDM, PLM and ERP functions is unique value proposition.

Propel PLM

Propel PLM, built on the Salesforce platform, offers a unique approach by leveraging CRM capabilities for PLM processes. The strategy of Propel is to integrate with customer oriented process. This integration facilitates better collaboration between product development and customer-facing teams. Propel’s cloud-native solution provides scalability and flexibility, making it a compelling choice for companies seeking to align product lifecycle management with customer experience management. Usage of Force.com platform provide a strong foundation for enterprise companies using Salesforce.com, but can be considered by some as an overhead. CAD and other integrations are provided by partners.

SaaS Services for Engineering and Manufacturing

In addition to the approach to provide a PLM solution, a growing number of SaaS services are focusing on specific aspects, process, and functions useful for engineering and manufacturing. These services are gaining traction for their ability to address niche needs with precision and agility. I recommend you to check Blake Courter’s Engineering Software Moat Map, a detailed overview of the competitive landscape in engineering software, highlights many of these specialized companies. Here are a few companies I found interesting (alphabetic order)

Authentise

Authentise specializes in data-driven workflows for additive manufacturing. The company’s solutions enable manufacturers to optimize production processes, improve traceability, and leverage real-time data for better decision-making.

CoLab

CoLab offers a collaborative platform specifically designed for design reviews. By enabling real-time feedback and collaboration, CoLab helps engineering teams streamline the design review process, reduce errors, and accelerate product development cycles.

Five Flute

Five Flute focuses on optimizing design reviews with a user-friendly interface that integrates seamlessly with existing CAD tools. The platform provides a centralized space for teams to manage feedback, track changes, and ensure design quality.

Jiga

Jiga provides a platform for part sourcing that simplifies procurement processes. By connecting manufacturers with suppliers, Jiga streamlines the sourcing of parts, reduces lead times, and enhances supply chain transparency.

What is My Conclusion?

The PLM market in mid-2024 is characterized by rapid innovation and a shift towards cloud-native, data oriented and AI-driven solutions. Established leaders like Siemens, Dassault Systèmes, and PTC continue to dominate, while emerging players like OpenBOM, Duro PLM, and Propel PLM are making significant inroads with their innovative approaches. Additionally, specialized SaaS services are addressing niche needs within engineering and manufacturing, offering targeted solutions that enhance efficiency of processes, effectiveness of decisions and collaboration. As companies increasingly seek agile, integrated solutions to manage complex product lifecycles, the PLM landscape will continue to evolve, driven by technological advancements and changing industry demands.

Just my thoughts…

Best, Oleg

Disclaimer: I’m the co-founder and CEO of OpenBOM, a digital-thread platform providing cloud-native PDM, PLM, and ERP capabilities. With extensive experience in federated CAD-PDM and PLM architecture, I’m advocates for agile, open product models and cloud technologies in manufacturing. My opinion can be unintentionally biased.