From time to time, I’m coming to discuss the intersections of engineering software and PLM. Here are some of my previous article. Looking back is always a good idea. Check this out

PLM Future business and social models (2010)

CAD seats and future business models (2016)

Future Business model – Pay per second PLM (2017)

Future Business model – Pay per feature and reverse data tokens (2020)

Over the past ten years, we’ve seen big changes in the business models used in engineering and manufacturing software. Companies developing CAD, PDM, PLM, and other applications focusing on production process, supply chain management, and business process application areas have moved away from selling perpetual licenses to offering subscription-based SaaS models. PLM solutions and PLM software is available using term business model (subscription). This shift has helped these businesses align with digital transformation trends, but it also raises questions about what’s next for these business models.

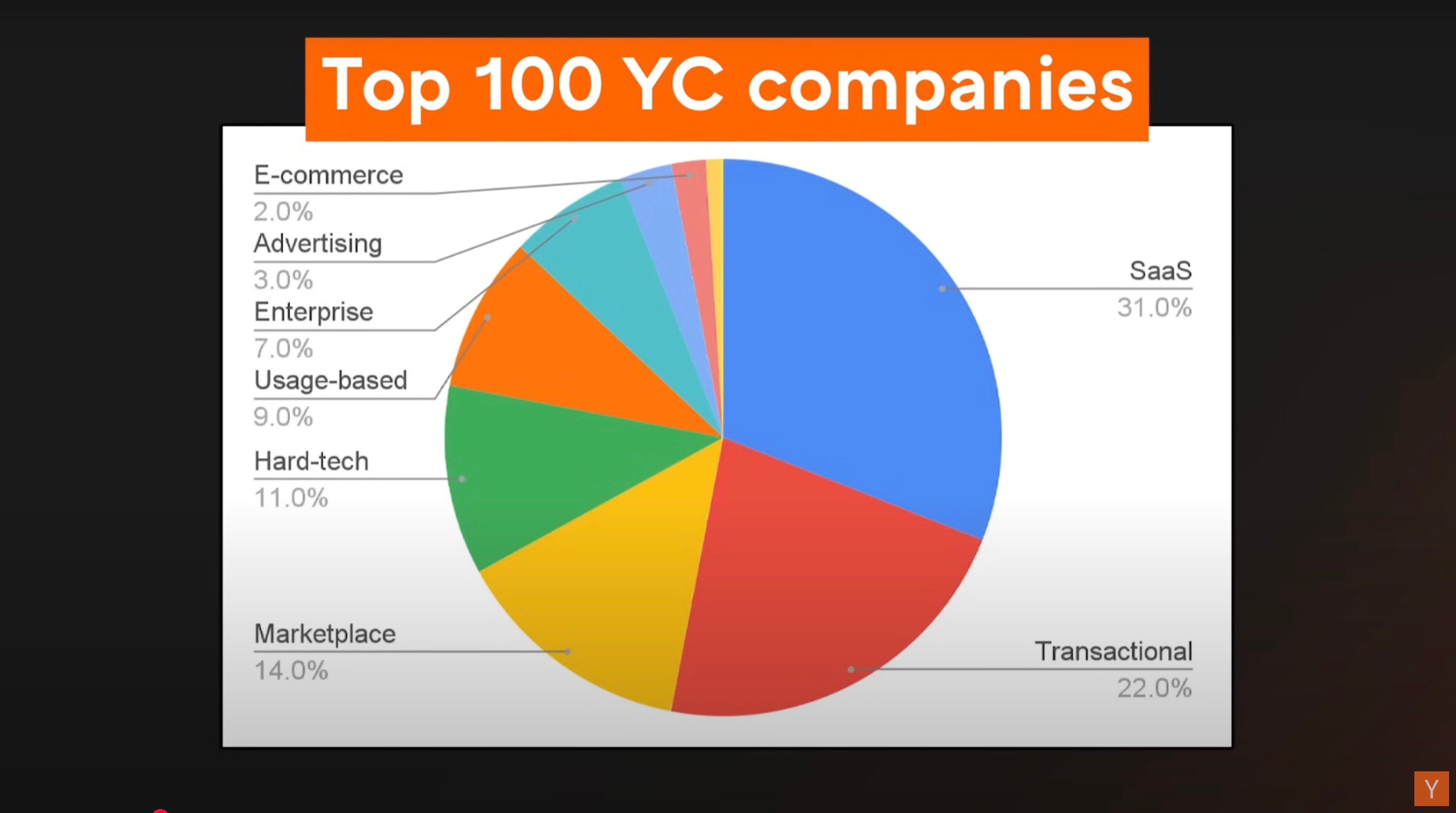

Today, I want to share some thoughts on the future of these models, inspired by industry trends and some fascinating data I found from YC. YC’s open data is a great resource for understanding how businesses are built and succeed, so I’ll use it to highlight a few key points. If you want to learn more, check this video.

What I Learned from YC’s Business Model Types

YC data on startups offers some interesting insights about common business models. Here are my takeaways:

Different Types of Business Models: YC companies use a mix of models, like SaaS subscriptions, transactional pricing, marketplace platforms, and usage-based pricing. These reflect broader trends in tech and manufacturing software.

How Business Models Are Distributed: SaaS is the most common model, but it doesn’t always deliver the best results. Transactional and marketplace models often outperform SaaS in certain niches because they scale better with customer activity.

Top Performers’ Models: The most successful YC startups tend to use transactional or usage-based models. For example, payment platforms and marketplaces often generate more revenue as they grow.

Who Struggles to Get to the Top: Companies heavily dependent on other platforms (like app stores or third-party integrations) tend to face challenges. Being tied to someone else’s platform can limit growth and control.

What This Means for CAD/PLM Business Models

1- SaaS Is Everywhere, But It’s Not Everything

Most CAD and PLM companies have embraced SaaS, but it’s not a perfect model. While recurring revenue provides stability, it can limit growth compared to models that scale directly with customer activity.

2- Transactional Models Are Growing

Transactional models, where revenue comes from customer activity (like per transaction or per use), have a lot of potential. In manufacturing, as supply chains and procurement go digital, transactional pricing could unlock new opportunities.

3- Risks of Platform Dependence

Companies that rely too much on other platforms, like app stores, face risks. They have less control over their revenue and customer relationships. Open, independent models seem to have better chances of long-term success.

Digital Transformation and Transaction-Based Opportunities

Digital transformation strategy is not only about the digital technology. Digital transformation initiatives might come together with new business models. One of the biggest trends in manufacturing is the shift to digital communication with suppliers. Businesses are moving away from emails and spreadsheets and adopting platforms that streamline these processes.

Collecting data, product data, cost management, business operations – this is just a short list of opportunities I can see for new business models.

This shift creates opportunities for transactional business models. For example:

- Supplier Marketplaces: Charging fees per transaction or per supplier match.

- Procurement Platforms: Offering volume-based pricing or service fees.

- Data Services: Providing pay-per-use analytics or insights.

These models align closely with how manufacturers operate and offer scalability beyond what traditional SaaS models can achieve.

What is my conclusion?

Digital transformation success and the future of business models in engineering and manufacturing software isn’t just about technology; it’s about finding the right way to create and capture value. SaaS may be the current standard, but transactional business models and marketplace models seem poised to drive the next wave of innovation.

Here’s what I think is important:

- Look out for transactional opportunities, especially in areas like supplier communication and procurement.

- Be cautious about relying too much on external platforms.

- Focus on creating business models that align with what customers revenue or spending streams

To succeed, Product Lifecycle Management might need to disconnect from traditional business models and look how to combine new digital technologies and digital transformation efforts with new business strategy. Product development process connected with a business environment can create interesting intersections. Companies need to innovate not just in technology but also in how we do business. Being where the money flows—whether through subscriptions, transactions, or usage—is key to staying ahead.

Just my thoughts…

Best, Oleg

Disclaimer: I’m the co-founder and CEO of OpenBOM, a digital-thread platform providing cloud-native collaborative services including PDM, PLM, and ERP capabilities. With extensive experience in federated CAD-PDM and PLM architecture, I’m advocates for agile, open product models and cloud technologies in manufacturing. My opinion can be unintentionally biased